Several threads have popped up on Reddit asking for money-saving tips in 2023 in the Canadian city, including one in r/askTO that has blown up with over 600 comments in less than two weeks.

From groceries to transportation and free activities, people living in Toronto are sharing lots of great hacks they use to keep costs down.

Here are the 10 best money-saving hacks we found online.

Tips to save on groceries

A woman shopping for apples at a grocery store.

Monkey Business Images | Dreamstime

Saving on groceries seems to be one of the biggest topics of discussion on several Reddit threads and locals living in Toronto are coming through with ways you can cut back on costs.

"Almost all my produce is from Chinese markets [in the] Dundas area," one person wrote online. "I save a ton of money by doing this but I go there frequently."

Another person agreed with the suggestion and added that you don't necessarily have to head to Chinatown if it isn't convenient.

"There is a lil green grocer in almost every neighbourhood that has better cheaper produce than the big stores."

Others shared the benefits of shopping at

Costco, where you can save on certain items.

"Costco is almost always worth it. Fruit and dairy especially are so much better and cheaper. Save big [on] detergents and soaps. Basic clothes like t-shirts and underwear are well priced," one commenter on Reddit advised.

Narcity's Lisa Belmonte recently

did a price comparison between Costco, Walmart, Fortinos and Metro. She found certain products like Kraft peanut butter, jars of Mutti passata, produce and bread are cheaper at Costco than they are at the other grocery stores.

Some people online also recommended checking flyers before heading out on your grocery run to see where you can get the best deals.

Another tip to keep in mind is that certain grocery stores will price match, which means you don't have to run to a number of stores to get all the deals you found.

"Grocery stores like Freshco, Real Canadian super store and No frills would do price match on select competitors’ flyers. Ask cashier for the retailer/competitor list," one person wrote in a r/askTO Reddit thread.

Shopping at Bulk Barn on Sundays

Shopping for certain products at Bulk Barn can save you money, especially on Sundays.

You can get 15% off if you go there on a Sunday and bring your reusable containers.

Narcity's Sarah Rohoman recently went to Bulk Barn and shared some of the items she chooses to buy there to save money.

One person online also shared an additional tip in that shoppers can "stack the discounts" with $3 and $5 coupons that can be found on the Bulk Barn website.

Going to the Toronto Public Library

Many people are highlighting how great of a resource the Toronto Public Library is and it's not all about books either.

"Aside from borrowing books, you can also use it to read lots of magazines and newspapers online, check out free passes for the ROM, AGO, etc, and my local branch even gives out free Presto cards (no money loaded but saves the $6 card purchase fee)," one person shared online.

"Plus passes to provincial National Parks. The Toronto Public Library is amazing!" another person wrote on Reddit.

Shopping on Facebook Marketplace

Buying furniture can get pricey so it's a good idea to check a few websites for used items before opting for new pieces.

One person online suggests going to IKEA to get ideas of what you're looking for and then seeing if you can find that exact or similar item on Facebook Marketplace for cheaper.

Finding free activities in the city

There is a lot to do in Toronto and some popular attractions even offer free admission on certain days of the week or month.

The Royal Ontario Museum (ROM) offers free nights for everyone on the third Tuesday of each month from 4:30 p.m. to 8:30 p.m.

The free admission includes free access to all galleries, plus the ROM's special exhibit: Being and Belonging and Death: Life's Greatest Mystery. The museum's website says no advanced tickets or bookings are required.

Two free nights are left for 2023: November 21 and December 19.

The Art Gallery of Ontario (AGO) also offers free admission every Wednesday from 6 p.m. to 9 p.m.

Unlike the ROM, visitors planning a trip to the AGO must book their free tickets in advance online.

"Every Monday, a limited number of free timed-entry tickets will be released for the following Wednesday night," it says on the website.

Check Dollarama for certain items like snacks and toiletries

Dollarama has a lot of great deals on a variety of items that will cost you more elsewhere.

Several people online shared that Dollarama is their go-to store when it comes to buying snacks.

"Snacks and junkfood (if that’s your thing) that are available at Dollarama should never be purchased anywhere except Dollarama. I’m astonished how anyone, wealthy or not, would pay $8 for a bag of cool ranch Doritos," one person wrote.

Dollarama also has an array of beauty products that will cost you less than if you were to buy them at a big box store.

Making coffee at home

It may not seem like a big money-saver, but making your coffee at home rather than buying one at work every day can certainly add up quickly!

Many Canadians expressed online that they have purchased a French press or coffeemaker and stopped buying lattes from coffee shops in the city.

"Buy a French press and a nice thermos and never buy coffee at a coffee shop again," one person wrote on Reddit.

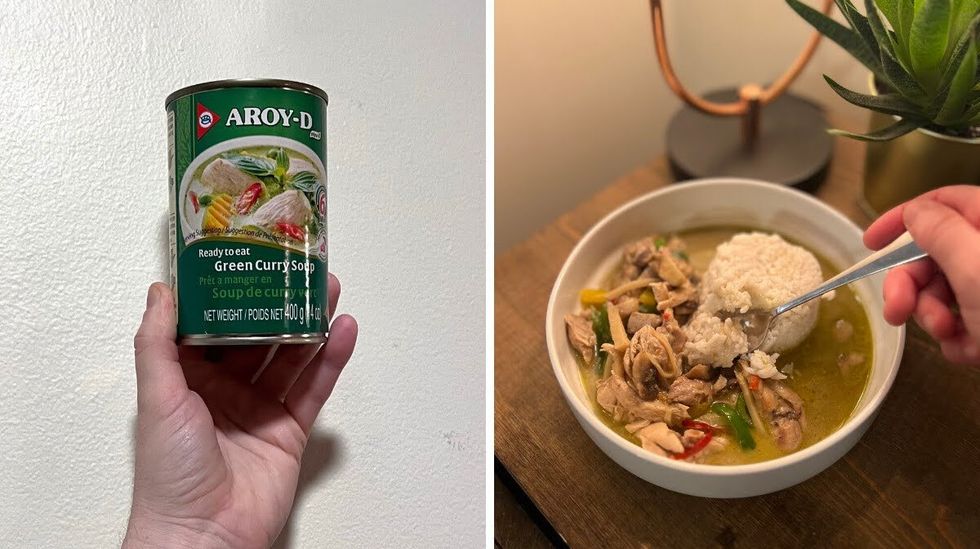

Cooking your meals & picking up your own food orders

Toronto is filled with restaurants and easy delivery options when it comes to lunch and dinner, but cooking at home is a huge opportunity to save a lot of money.

Canadians online seem to agree that meals should be prepped a home and if you are ordering food online, then at least don't do delivery.

"Stop eating out, meal prep your lunches and coffee and cook at home. You are losing tons of money on dining out," one person wrote on Reddit.

"If you want take out, just go pick it up yourself," another comment reads to which someone replied, "The markup and fees on Uber eats and the like are absolutely killer."

Using your washer, dryer and dishwasher at "off peak times"

A woman turning on the dishwasher.

Brizmaker | Dreamstime

Did you know that you can cut down on electricity costs by simply using your washer, dryer and dishwasher at off-peak times?

"Electricity literally costs double if you use it from 5-7pm," one person wrote on Reddit.

You can check out the Toronto Hydro website to read up on how the rates work at certain times of the year and how much you can save by simply keeping an eye on what time you do chores around the house.

For instance, between November 1, 2023 and April 30, 2024 off-peak hours are from 7 p.m. to 7 a.m. on weekdays and all day on weekends and holidays.

It will cost you about 8.7 cents per kilowatt-hour (kWh) during off-peak hours versus 18.2 cents per kWh for using your washer during on-peak hours.

Choosing to walk or bike vs. cabbing and driving

Using Uber and taking cabs in Toronto is a super convenient mode of transportation to get from point A to point B in the city.

However, many people point out that downtown Toronto is walkable and going by foot will keep money in your pocket.

"Things in central-ish Toronto are closer than they appear. You'd be amazed at how far you can walk in a reasonable time saving money on TTC/cab/car," one person wrote.

"Especially in the summer when the weather is nice. I bike as much as I can, and if I'm going out drinking, I'll rent a bike down and transit home," another person shared.

This article's cover image was used for illustrative purposes only.

A tourist sits on a peak overlooking Machu Picchu.

A tourist sits on a peak overlooking Machu Picchu.  A person smiles at the camera before doing a canyon swing over a ravine in New Zealand.

A person smiles at the camera before doing a canyon swing over a ravine in New Zealand.

Planning for retirement now means you can relax about the future. New Africa | Adobe Stock

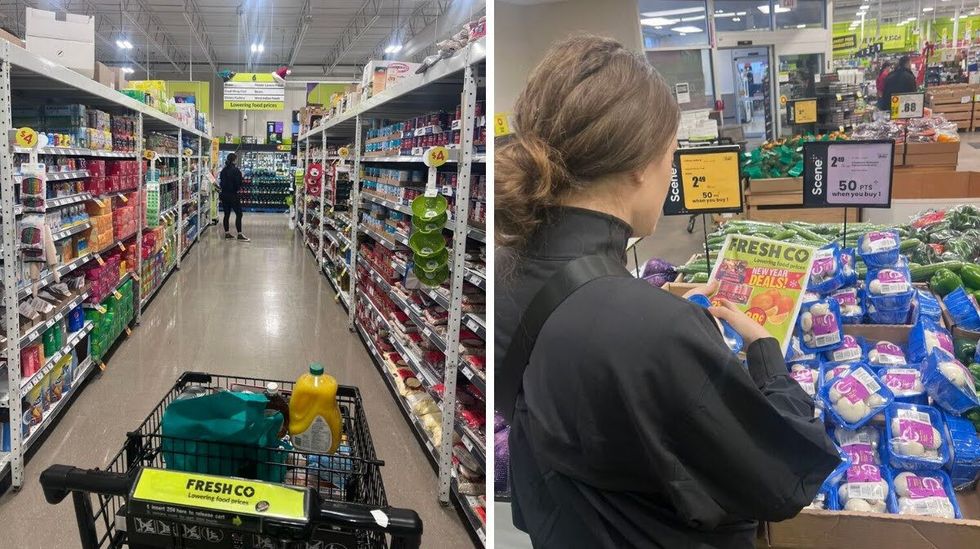

Planning for retirement now means you can relax about the future. New Africa | Adobe Stock You can find affordable groceries at FreshCo.

You can find affordable groceries at FreshCo.

Fish tacos are an exciting and affordable dish to make.

Fish tacos are an exciting and affordable dish to make. No worries, FreshCo.

No worries, FreshCo.