Whether you're new to homeownership or you've been saving up to get on the property ladder, there are a whole bunch of Canadian expenses, credits and grants that you might qualify for that could help save you money at tax time — especially if you're eligible for more than one.

What's more, some of these programs like the First-Time Home Savings Account and Multigenerational Home Renovation Tax Credit are new for 2023, so you may not have applied for them — or even heard of them — until now.

From the Home Buyers' Plan and First-Time Home Buyers' Tax Credit to the Canada Greener Homes Grant, here's a look at the credits, grants and expenses that all homeowners (or hopeful homebuyers) should be aware of.

First-Time Home Buyers' Tax Credit (HBTC)

The First-Time Home Buyers' Tax Credit (HBTC) now enables most first-time homebuyers to claim up to $10,000 for the purchase of a qualifying home.

That means a non-refundable tax credit of up to $1,500 (15%) from the federal government — and all you have to do to qualify is file a tax return.

Eligibility requirements include not previously living in another home you or your partner owned, and buying a property that qualifies.

The credit applies to different types of homes, including single-family houses, townhouses, condos and more.

Previously, the tax credit amount was $5,000, but this was upped to $10,000 for 2022 and subsequent tax years.

Home Buyers' Plan (HBP)

The Home Buyers' Plan also supports first-time buyers in getting their first home.

If you're eligible, the HBP allows you to withdraw up to $35,000 from your Registered Retirement Savings Plan (RRSP), tax-free, for the purpose of buying or building a home, either for yourself or for a family member with a disability.

Any withdrawn money will need to be paid back into an RRSP account within 15 years, and minimum payments must be made each year to avoid amounts being added to your taxable income for that year.

While funds withdrawn from an RRSP are usually considered income and are therefore subject to tax, eligible HBP withdrawals are not taxed.

The eligibility criteria include being a resident of Canada, being a first-time homebuyer and having a written agreement to buy or build a home.

First Home Savings Account

This April, for the first time, Canadians will also be able to make use of the First Home Savings Account (FHSA).

The FHSA is a new registered plan that will allow prospective first-time homebuyers to set aside up to $40,000, with tax-deductible contributions and non-taxable withdrawals.

An account can remain open for up to 15 years but must be closed after December 31 of the 15th year or the year you turn 71, whichever comes first.

Alternatively, if you make a qualifying withdrawal to buy a home, the account must be closed shortly after.

The eligibility criteria state that a qualifying individual must be a Canadian resident, at least 18 years old and be a first-time homebuyer.

Canada Greener Homes Grant

The Canada Greener Homes Grant is a non-taxable and non-repayable grant that will help to cover the cost of making your home more environmentally friendly.

The amount on offer ranges from $125 to $5,000 depending on your costs, and it can be used towards updates like home insulation, new windows and doors, energy-efficient space heating or water heating, and air sealing, to name a few.

The Canada Greener Homes Grant is open to homeowners across Canada who make a qualifying change on an eligible property.

Find out more

Home Accessibility Tax Credit (HATC)

The recently updated Home Accessibility Tax Credit is a non-refundable tax credit for property renovations that make a home more accessible for qualifying individuals.

To be eligible, the renovation or modification must either make the property more accessible for an individual or reduce the risk of harm to the individual.

For the 2022 and subsequent taxation years, the annual expense limit has increased from $10,000 to $20,000, which means taxpayers can claim a tax credit of up to $3,000 (15%).

There are eligibility criteria for both the applicant and the property in question, both of which can be found online.

Multigenerational Home Renovation Tax Credit

Another new tax credit for 2023 and the subsequent taxation years is the Multigenerational Home Renovation Tax Credit, which helps families pay for renovations if a qualifying individual (a senior or an adult who is eligible for the disability tax credit) comes to live with them.

Eligible people will be able to claim qualifying expenditures of up to $50,000, resulting in a non-refundable tax credit of up to $7,500.

The eligibility criteria include restrictions on the renovations, the relation of the individual and if they qualify, the period renovations were completed and more — so check thoroughly before applying.

GST/HST New Housing Rebate

Homeowners who purchased or built a new house (or substantially renovated an old one) to live in may also be eligible for the GST/HST New Housing Rebate.

This allows individuals to recover some of the GST or the federal part of the HST paid for an eligible house, provided all conditions are met.

The qualification criteria may exclude some homebuyers, particularly as it is not available to a corporation or a partnership, but it's worth checking out if you think you could be eligible.

Home office expenses

Don't forget, if you work from home, including temporarily due to the COVID-19 pandemic, you may be eligible to claim home office expenses at tax time.

There are two methods of claiming: the temporary flat rate method and the detailed method. The former allows you to claim up to $2 per day for each day worked at home, while the latter allows you to claim the actual amounts you paid — but you will need to provide supporting evidence.

Both methods have slightly different eligibility criteria, so read up online before filing to pick which option suits your circumstances best.

It's worth keeping in mind that, as some of these programs are new for this year, they will not apply to your 2022 taxes and will only become applicable when you file this year's taxes in 2024.

This year, the deadline for most Canadians to file is April 30. However, as this falls on a Sunday, your return will still be considered on time if the CRA receives it or it is postmarked on or before May 1.

If you're already thinking ahead, the tax brackets for 2023 have already been confirmed and can be found here.

This article's cover image was used for illustrative purposes only.

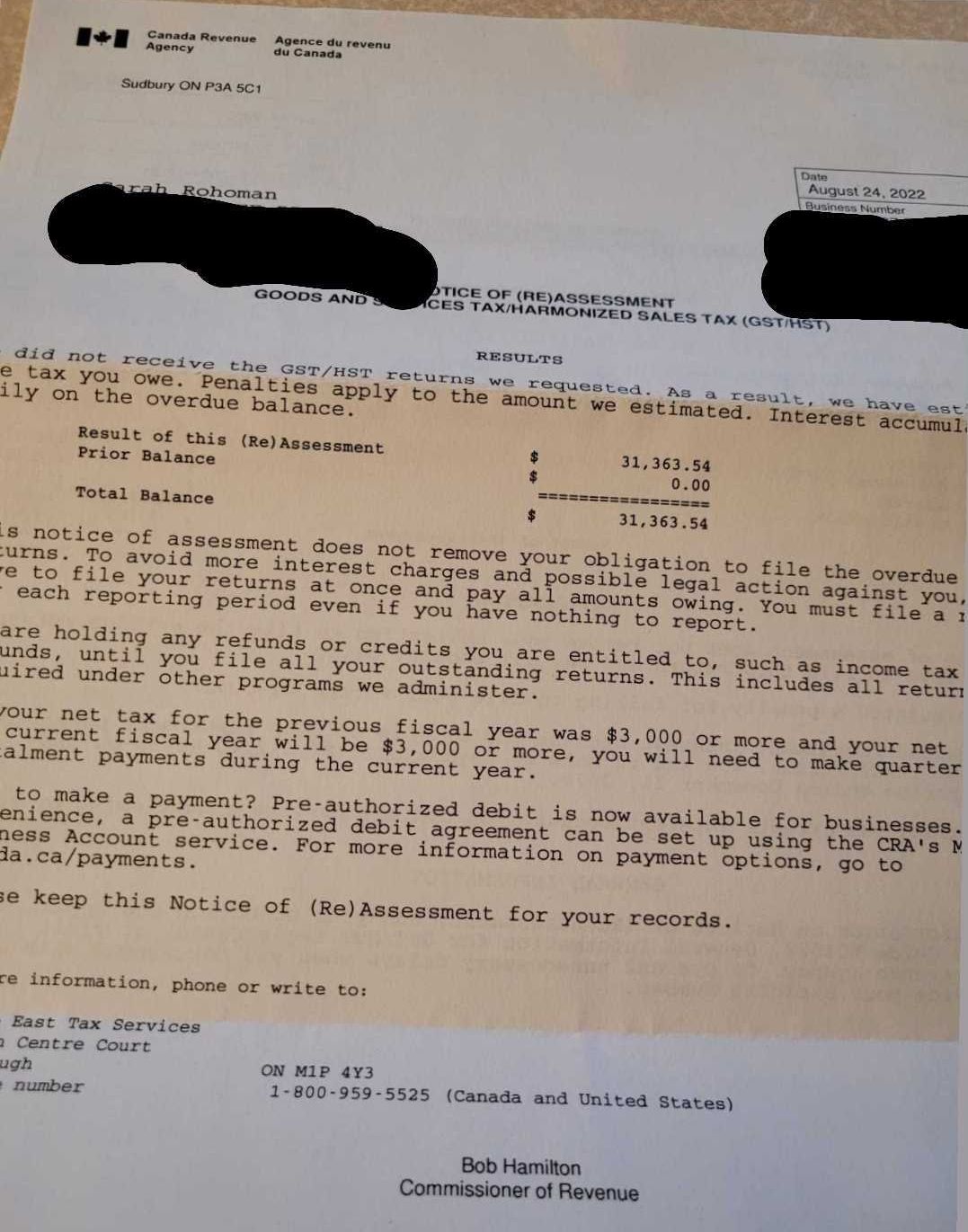

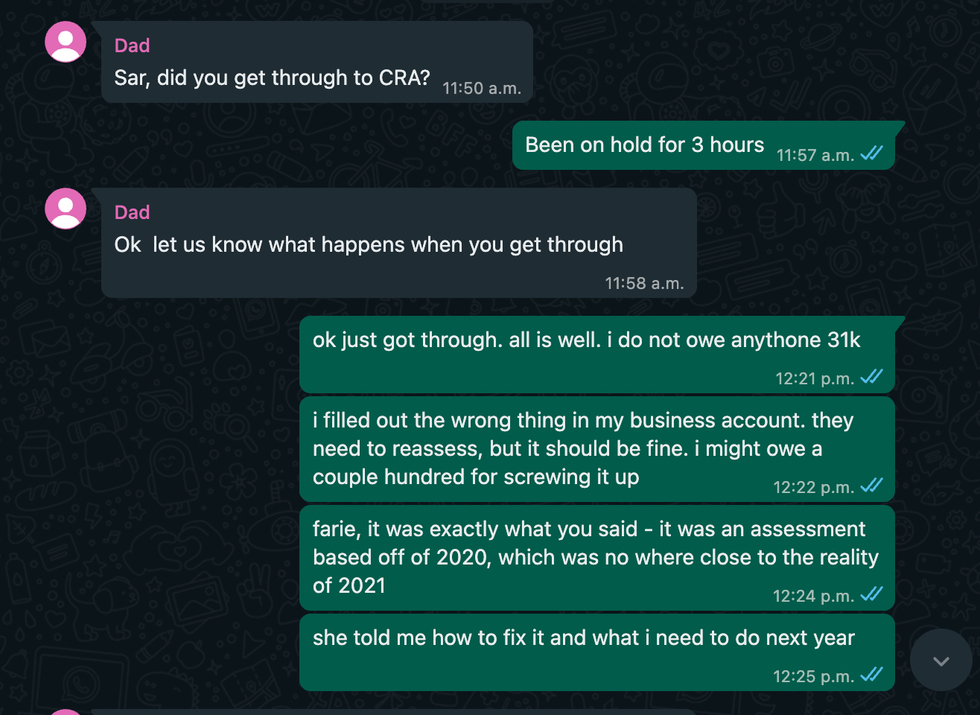

A text from Sarah's mom telling her she owes the CRA $31K.

A text from Sarah's mom telling her she owes the CRA $31K.