The CRA Told Me I Owed $31,000 In Tax Last Year & No, It Wasn't A Joke Or Scam (PHOTOS)

To say I had a panic attack is an understatement.

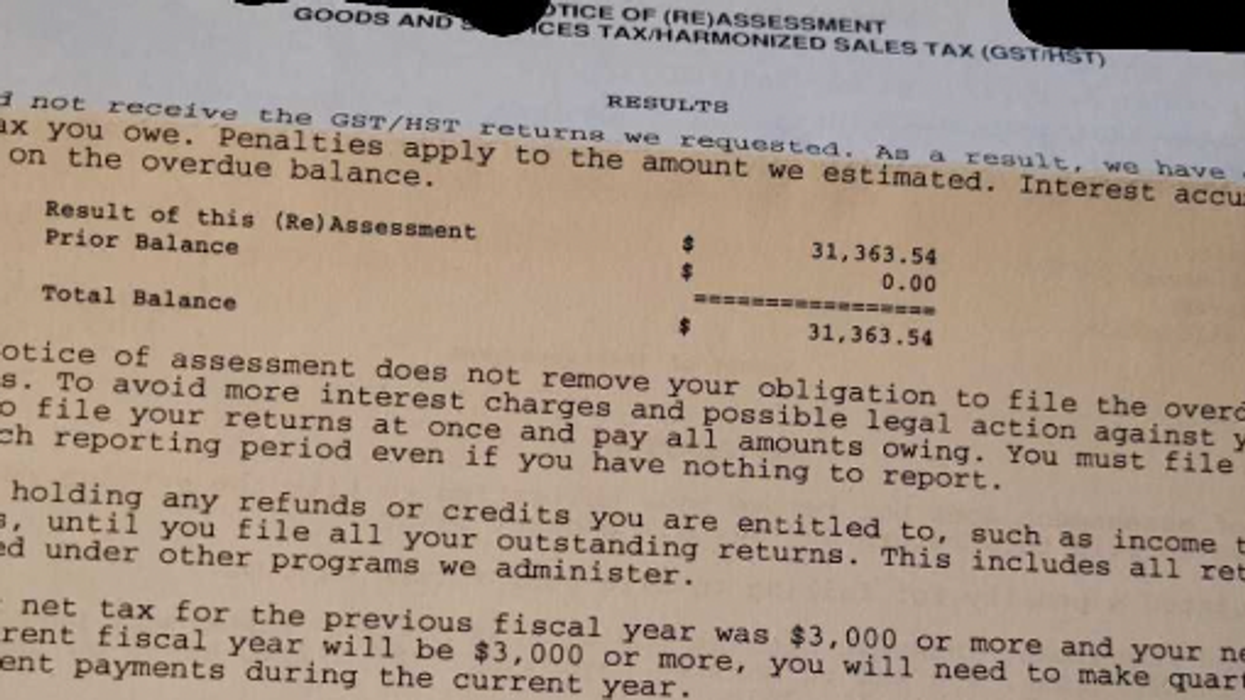

Sarah Rohoman's HST reassessment.

The opinions expressed in this article are the author's own and do not necessarily reflect the views of Narcity Media.

When it comes to personal finance, I'll admit I'm not the savviest individual, but when I found out that I'd been reassessed by the Canada Revenue Agency (CRA) for my 2021 work year and owed over $30,000, I could not fathom what I'd f*cked up so badly.

Late in August of 2022, I was driving my boyfriend back to his apartment. He was holding my phone and noticed that my mom was trying to call me, but as I was driving, I told him I'd call her back when I had parked.

He then told me she had texted me, so I asked him to read the message to me. He unlocked my phone and hesitated for a few seconds. Fearing the worst, I demanded he told me what it said.

The text read: "Call. U were reassessed by CRA claiming you owe $31k in HST."

Needless to say, my stomach absolutely dropped, and I immediately pictured myself having to move back in with my parents and send every paycheque I earned to the CRA for at least a year.

Thankfully, that didn't turn out to be the case, and honestly, the whole thing is my fault for not understanding the forms I needed to fill out for my business.

The background

Prior to working at Narcity, I was a freelancer for other publications, which meant I qualified as my own business. In Canada, if you make over $30,000 in non-taxed income, you need to pay tax on it, which in my case was HST.

Since I was making more than that threshold, I used an accounting software to keep me organized as I find money to be incredibly confusing.

For my work in 2020, I owed the CRA around $18,000 — but since I had kept track of what I would need to send them, the figure was not a surprise to me, and I had that money put aside exactly for that purpose.

In 2021, I did not make enough while freelancing to meet the $30,000 threshold as part way through the year, I entered a salaried job where tax was automatically taken out of my paycheque.

I didn't think I'd owe the CRA anything for my 2021 working year, and when I filed my taxes, I didn't — until I got the reassessment in August of 2022.

What happened next

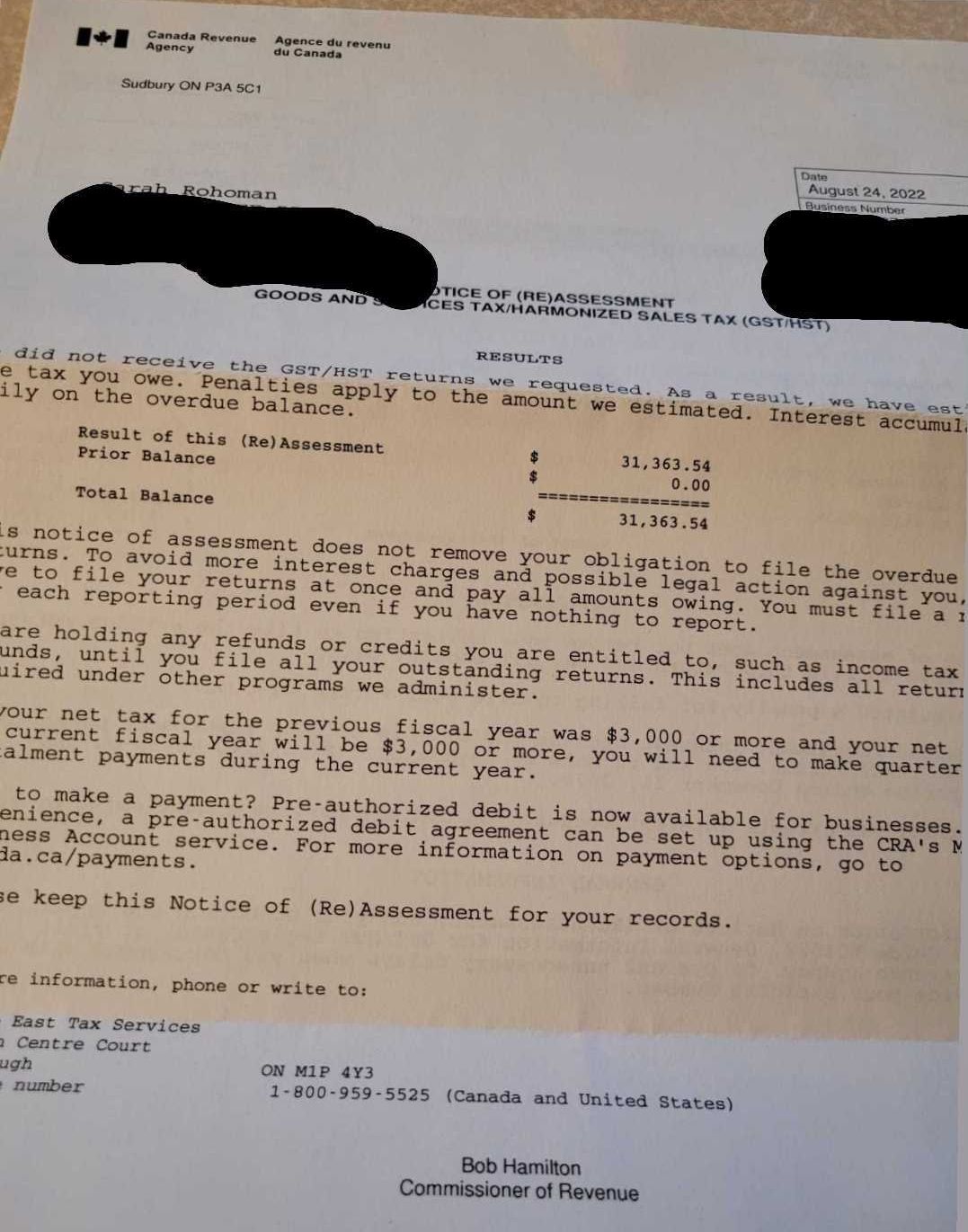

Sarah's letter from the CRA.

The following day, after getting on the phone with a very helpful CRA agent named Jennifer, the problem became clear almost immediately.

Since I hadn't filed business income but had filed personal income for 2021, the CRA estimated how much they thought I'd made in business income and reassessed my file based on that figure.

Given that I previously owed them $18,000, I'm not sure how they thought I'd increased my income enough to owe them $31,000, but that's exactly what happened.

After explaining that I hadn't made significant business income in 2021, Jennifer walked me through the steps to fill out what I needed to.

The solution

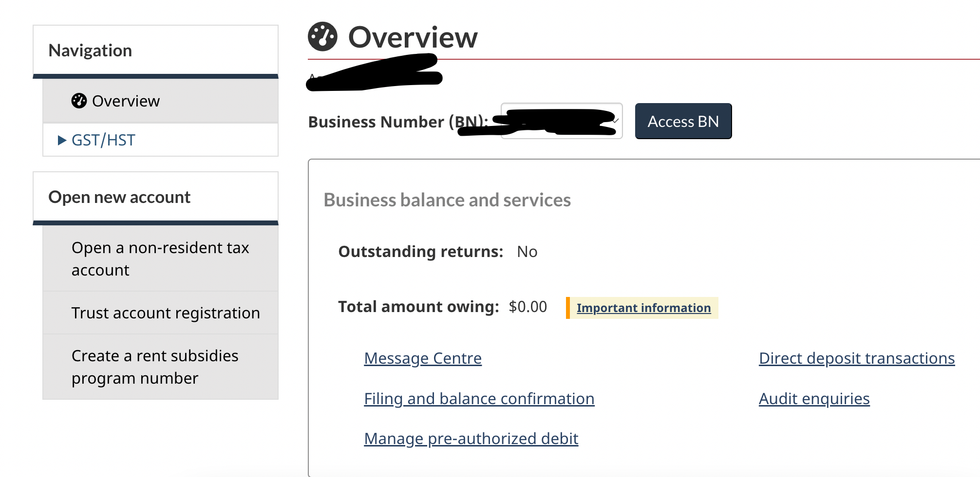

Sarah's CRA Business Account.

After signing into the CRA My Business account and filling out my business income for 2021, the amount I owed was reassessed, and the number almost immediately changed from $31,000 to $0.

It was literally as easy as two minutes of inputting some numbers.

The lesson

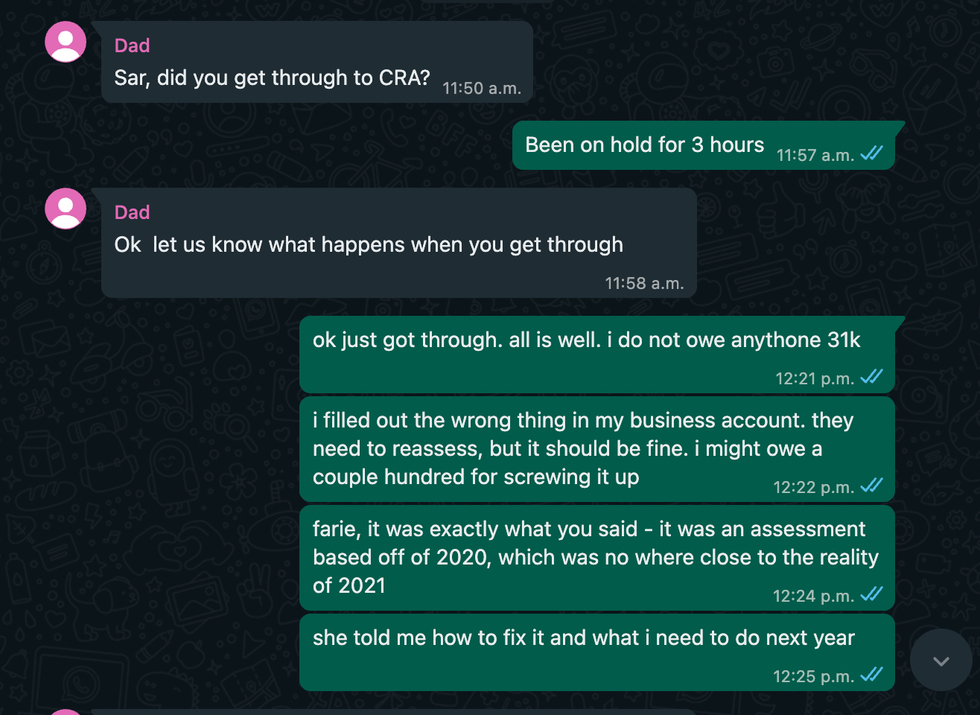

Sarah's family group chat.

So, if you don't really understand taxes, do yourself a favour and shell out the $50-something bucks it costs to hire a professional.

While I was able to sort the problem out pretty quickly, it caused me an incredible amount of stress during the 17 hours until it got sorted out. And, it was something a professional would have advised me to do in the first place.

Shout-out to Jennifer at the CRA for having my back — and for telling me how to avoid this problem for my 2022 taxes.

Best of luck this tax season, folks!

This article's cover image was used for illustrative purposes only.

- These Are Canada's Tax Brackets For 2022 & Here's What It Means For Your Taxes ›

- 9 Big Changes The CRA Wants You To Know About That Could Impact Your 2022 Taxes ›

- The CRA Just Shared Tax Tips For Newcomers To Canada & The Advice Is Seriously Helpful - Narcity ›

- Here's How Canadians Can Avoid Getting Duped By Scammers Posing As The CRA This Tax Season - Narcity ›

- Canada's Tax Brackets For 2024 Are Out Now & This Is How Your Taxes Will Be Impacted - Narcity ›

- 4 ways not filing your taxes this year can cost you money, according to an expert - Narcity ›

- The Canada Revenue Agency will review around 200K Canadians' benefits in 2025 — Here's why - Narcity ›