Canada's best bank accounts for 2026 were ranked and one of the Big Five got left in the dust

If you're wondering which Canadian bank is the best place to put your money right now, a new ranking of Canada's best bank accounts for 2026 might surprise you — especially if you're banking with one of the Big Five.

The latest moneyGenius Best of Money Awards just dropped, highlighting the best chequing and savings accounts across the country for 2026.

And while some big names won awards, one major bank was conspicuously absent — a pretty big deal if you're comparing the best banks in Canada.

From RBC and Scotiabank to digital challengers like EQ Bank and Wealthsimple, the winners span all types of financial institutions, and the range of options might make you rethink your personal finance game.

Whether you're after top-tier perks, no monthly fees, a huge welcome bonus or just the highest savings rate you can get, the 2026 rankings break it all down.

READ ALSO: Esso vs. Shell vs. Petro-Canada: Here's which gas station has the best loyalty program

According to moneyGenius, each account was reviewed and scored based on a bunch of factors like fees, interest, rewards, perks and overall value, using their data-driven Genius Rating system.

And spoiler alert: Canada's second-largest bank, TD, didn't win a single award this year. So if you're still sticking with them out of habit, you might be leaving money on the table.

Here's a look at the 13 chequing and savings accounts named best in the country in their category for 2026.

Best overall chequing account

- Monthly fee: $30.95 (waived with $6,000 balance)

- Free transactions & Interac e-Transfers: Unlimited

What stands out: Big perks like free international transfers, Scene+ rewards, credit card fee waivers and up to $700 in welcome bonuses. MoneyGenius points out this is an especially great option if you're already deep into the Scotiabank ecosystem.

Best no-fee chequing account

- Monthly fee: $0

- Free transactions & Interac e-Transfers: Unlimited

What stands out: No fees, free e-Transfers and access to Scotiabank ATMs across Canada. Plus, a clean app and occasional promo bonuses make this a top pick for digital banking fans. The report calls it one of the best no-fee chequing options for Canadians who want simplicity and flexibility without giving up key features.

Best chequing account for rewards

- Monthly fee: $0

- Interest: 2.2%

- Free transactions & Interac e-Transfers: Unlimited

What stands out: You earn PC Optimum points on debit purchases, and there's a generous welcome bonus to get you started. MoneyGenius highlights this account as a great choice for everyday spending if you're already shopping at Loblaws-affiliated stores.

Best interest-earning chequing account

- Monthly fee: $0

- Interest: 1.25% to 2.25%

- Free transactions & Interac e-Transfers: Unlimited

What stands out: This hybrid account gives you high interest with no monthly fees or FX charges. According to the ranking, it's especially appealing for investors or anyone who wants to earn while they spend.

Best chequing account for newcomers to Canada

National Bank Newcomer Banking Package

- Monthly fee: $15.95 (up to 3 years free for newcomers)

- Free transactions & Interac e-Transfers: Unlimited

What stands out: Specifically built for new Canadians, this account offers pre-arrival setup, affordable transfers and even a legal hotline. MoneyGenius also says the support in multiple languages is a major win for people just starting out in the country.

Best chequing account for seniors

- Monthly fee: $16.95 (seniors pay max $10.95)

- Free transactions & Interac e-Transfers: Unlimited

What stands out: Monthly fees scale based on usage, which can save you money. Seniors get an automatic discount, and the account includes extras like free money orders and drafts. The report calls it a practical choice for older Canadians who want flexibility.

Best chequing account for students

RBC Advantage Banking for Students

- Monthly fee: $0

- Free transactions & Interac e-Transfers: Unlimited

What stands out: Full-time students get fee-free banking, access to RBC Rewards and even gas discounts at Petro-Canada. According to moneyGenius, these features make it one of the most popular student accounts in Canada.

Best chequing account welcome bonus

- Monthly fee: $17.95 (waived with $4,000 balance)

- Free transactions & Interac e-Transfers: Unlimited

What stands out: A wild welcome bonus worth up to $700, plus bonus offers if you open additional BMO products. The ranking notes it's also a good pick for newcomers, students and families thanks to its tailored perks.

Best U.S. dollar account

- Interest: 2.5%

- Free transactions & Interac e-Transfers: 0

What stands out: As the winner of the award for best U.S. dollar account in both the chequing and savings categories, this account can do it all. You'll earn one of the highest USD interest rates in Canada with no monthly fees. The report recommends this account if you get paid in U.S. dollars or shop online with U.S. retailers often.

Best overall savings account

- Interest: 1% to 2.75%

- Free transactions & Interac e-Transfers: Unlimited

What stands out: This hybrid account has zero fees, earns you up to 2.75% with direct deposit and includes a prepaid Mastercard with 0.5% cash back. In fact, it also won this year's award for best savings account with unlimited transactions. MoneyGenius says it's one of the best all-in-one accounts for both saving and spending.

Best basic savings account

- Interest: 0.7% (plus 4.55% promo rate)

- Free transactions & Interac e-Transfers: 0

What stands out: It's simple, straightforward and backed by a major Canadian bank. While the rate isn't as high as some online options, it's a good fit if you want something low-effort with a trusted name behind it.

Best savings account promo rate

Scotiabank MomentumPLUS Savings Account

- Interest: 0.4% to 0.85% (4.75% promo rate for first 3 months)

- Free transactions & Interac e-Transfers: 0

What stands out: This no-fee savings account offers one of the highest promo rates on the market right now. According to the ranking, it's ideal if you're planning to park your money for a few months and want to max out your return.

Best savings account regular rate

- Interest: 2% to 3.5%

- Free transactions & Interac e-Transfers: Unlimited

What stands out: This hybrid account pairs savings with a prepaid card and earns both cash back and interest. MoneyGenius notes it's a solid option if you’re looking for a high everyday rate without locking your money in.

READ NEXT: These are Canada's best credit cards for 2026, from cash back to travel rewards

AI tools may have been used to support the creation or distribution of this content; however, it has been carefully edited and fact-checked by a member of Narcity's Editorial team. For more information on our use of AI, please visit our Editorial Standards page.

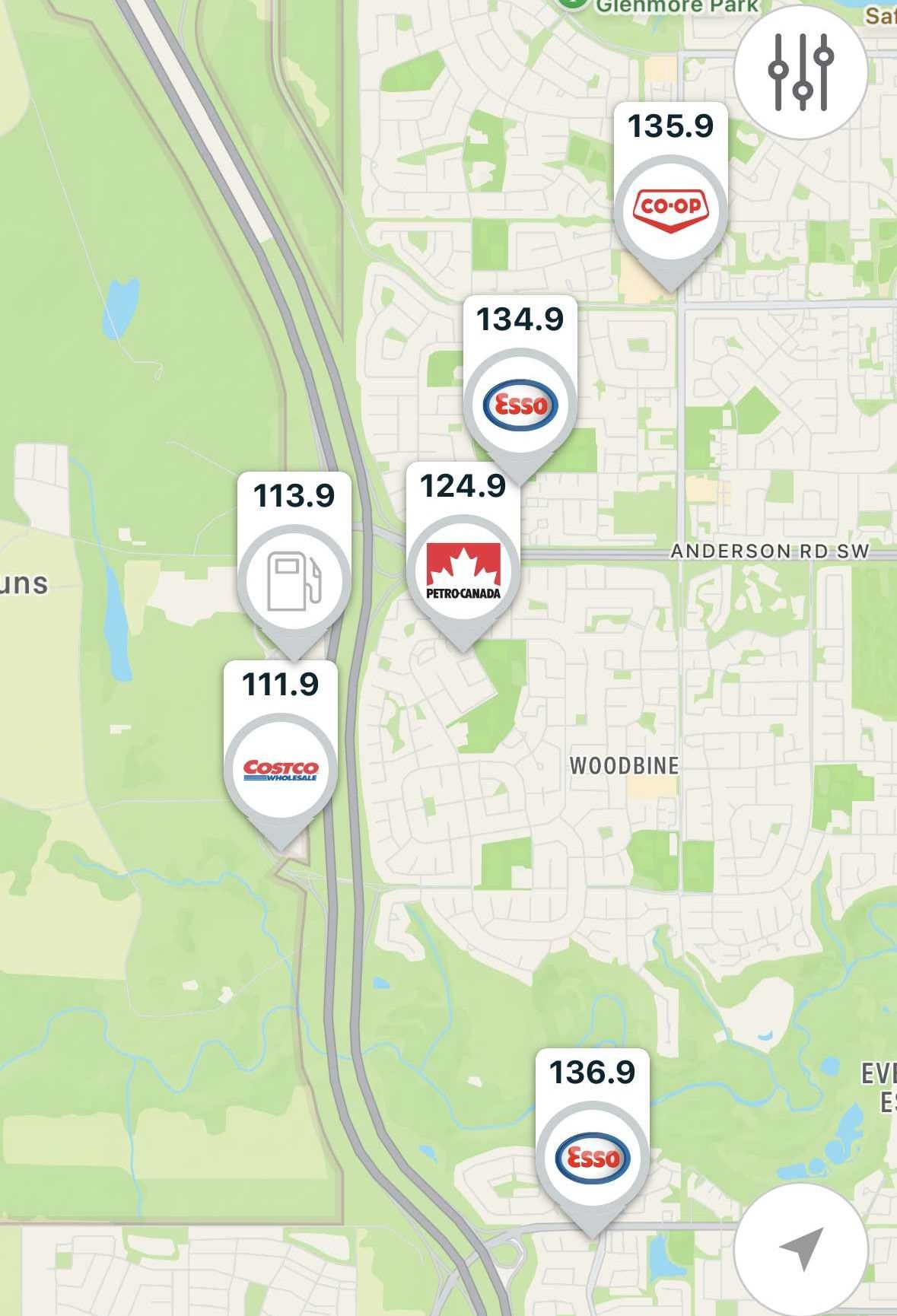

Filling up at the Tsuut'ina Gas Stop next door to the SW Calgary Costco saves you over 20 cents compared to other gas stations in the area.GasBuddy

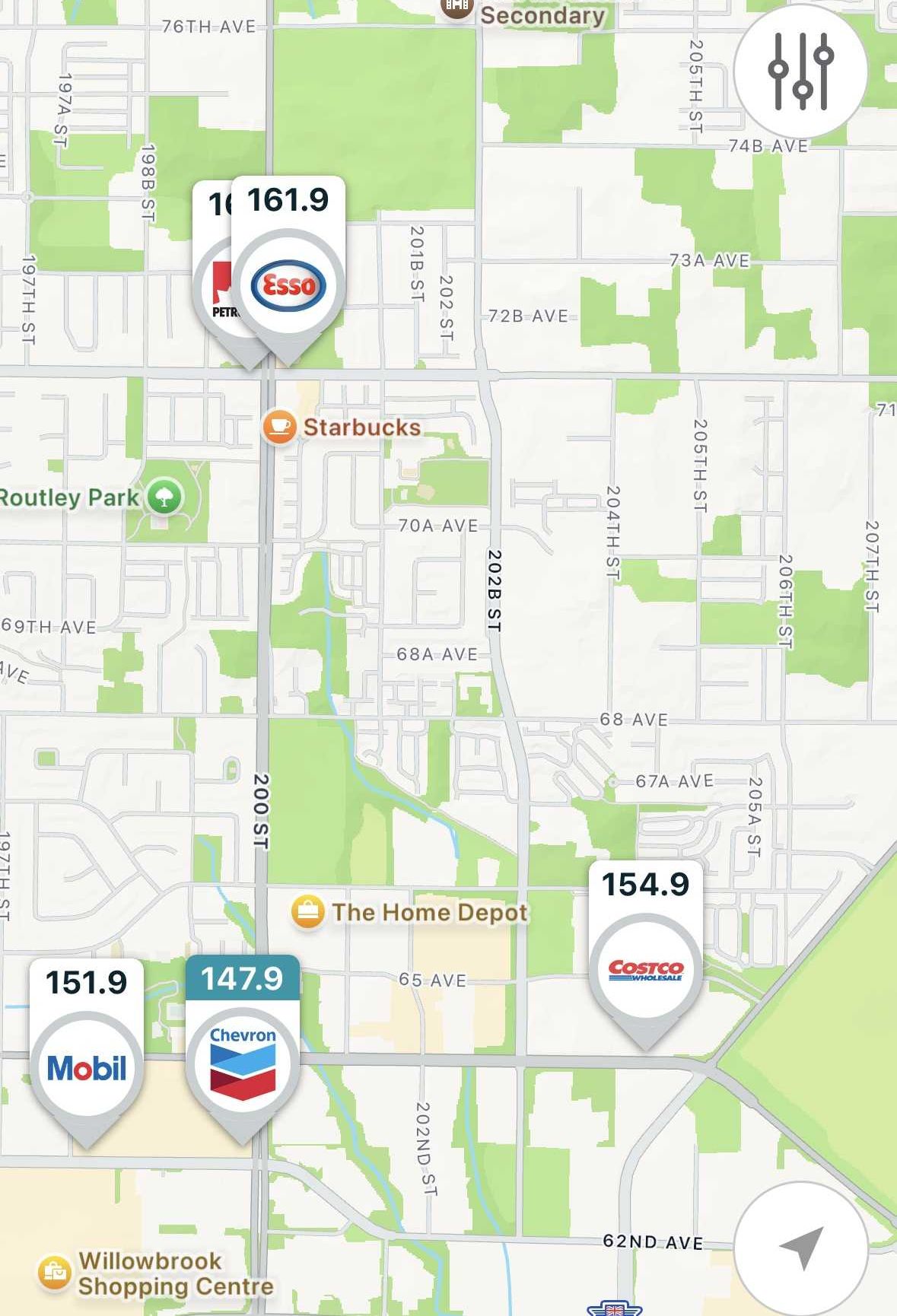

Filling up at the Tsuut'ina Gas Stop next door to the SW Calgary Costco saves you over 20 cents compared to other gas stations in the area.GasBuddy The Chevron and Mobil gas stations next to Costco Langley were actually cheaper than Costco's price.GasBuddy

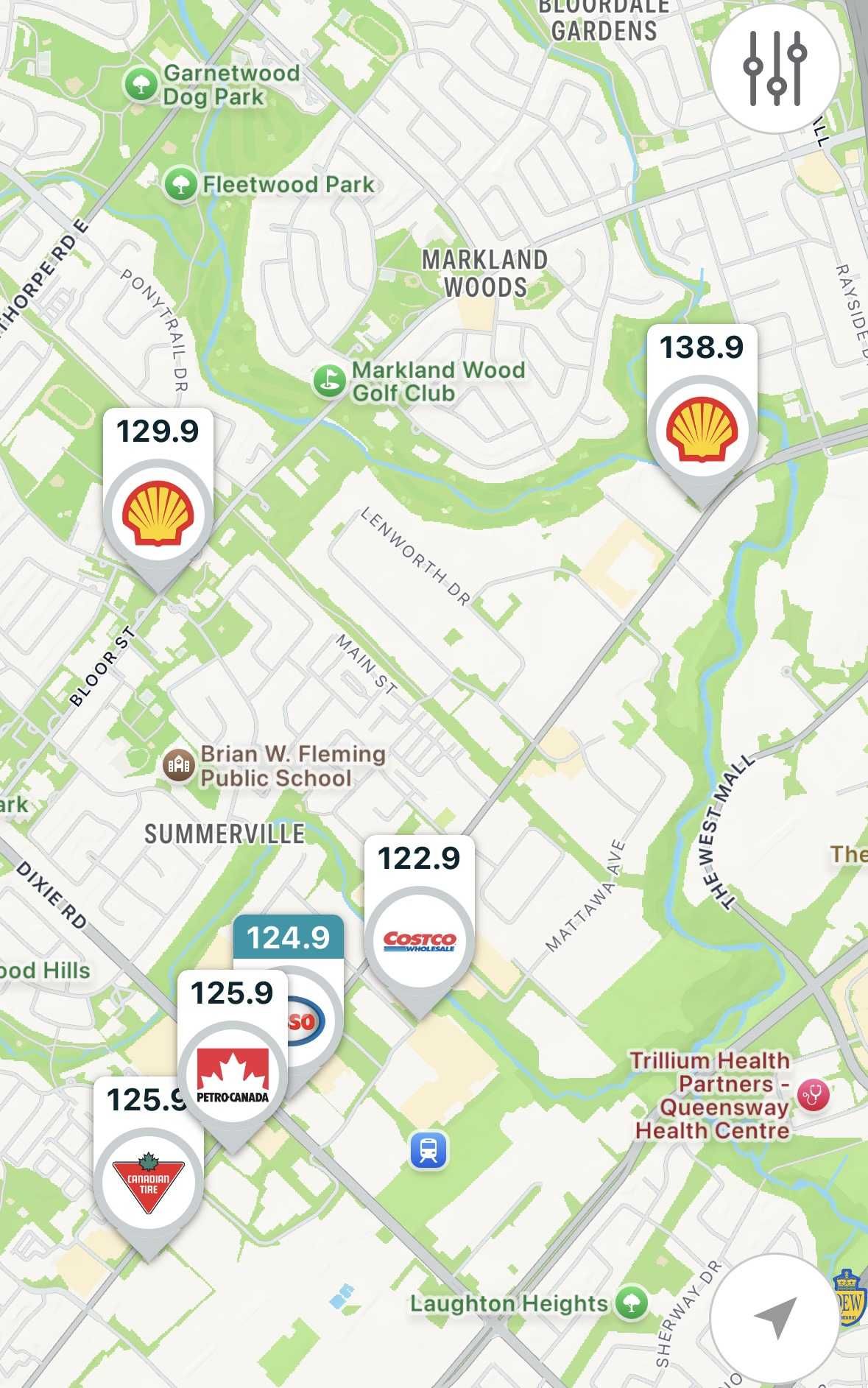

The Chevron and Mobil gas stations next to Costco Langley were actually cheaper than Costco's price.GasBuddy Mississauga drivers have a bunch of competitive options along Dundas Street East.GasBuddy

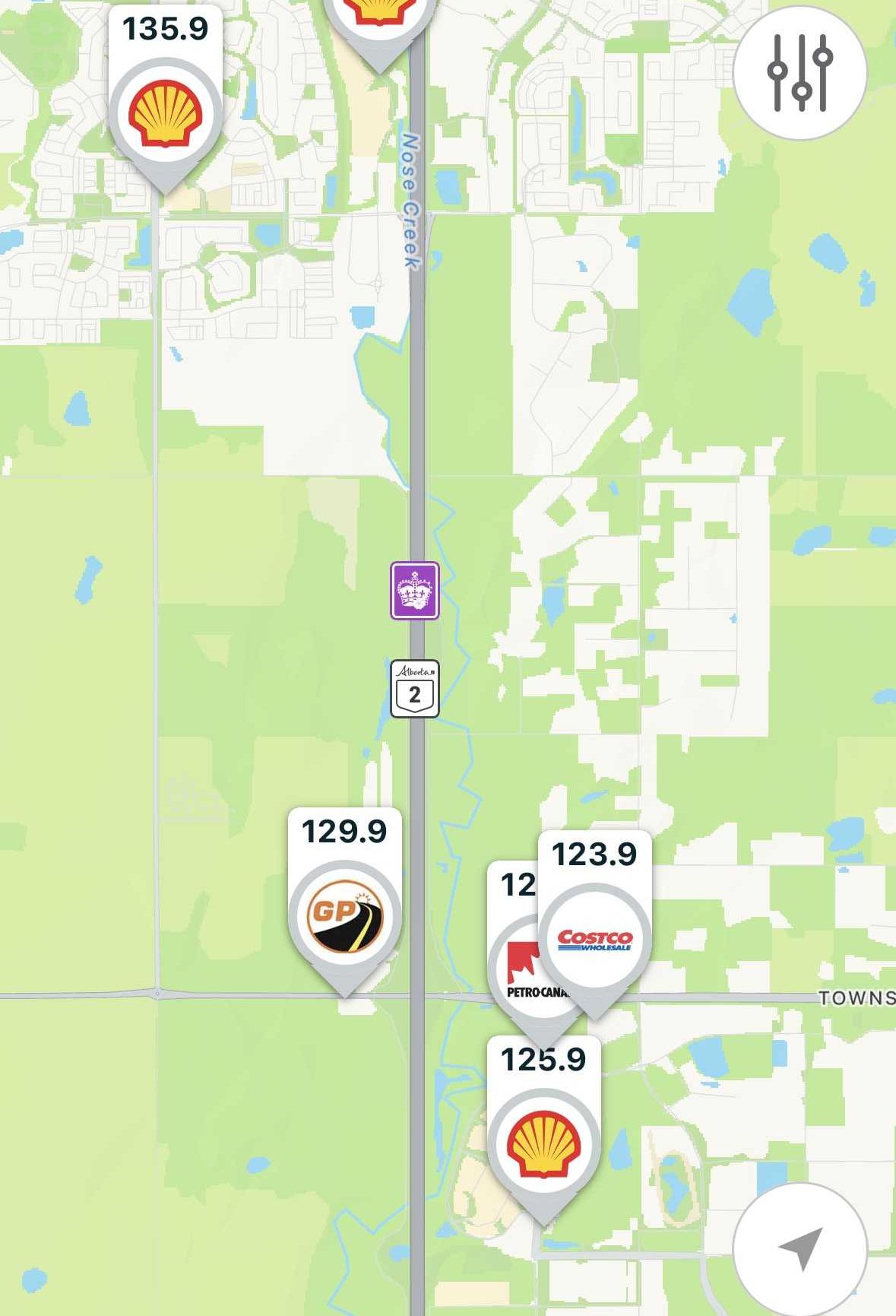

Mississauga drivers have a bunch of competitive options along Dundas Street East.GasBuddy Prices around Costco Rocky View increased the farther away they were.GasBuddy

Prices around Costco Rocky View increased the farther away they were.GasBuddy