This cheap gas hack can save you up to 20 c/L — no special app or membership required

If you've ever felt like gas prices in Canada are constantly on the move — up one day, down the next, but never low enough to feel like a win — we see you.

But with everyone trying to find the cheapest gas nearby, there's a simple trick that could save you a surprising amount of money at the pump — and most people don't even know it exists.

You've probably heard that gas prices at Costco are usually among the cheapest around. With 80 locations across the country, the membership-based warehouse chain is a top destination for drivers trying to save at the pump.

And for good reason. Narcity recently tracked daily gas prices at every Costco gas station in Canada over the course of a month and compared them to the average price at other stations in the same city. The savings varied by location, but on average, Costco gas was about 9 cents per litre cheaper, with some locations offering as much as 24 cents off on certain days.

But there's a catch: You need a paid membership to fill up at Costco. And even if you have one, the lines can be long enough to make you question if it's really worth it.

READ ALSO: Is a Costco membership worth it for gas alone? We did the math

But what if we told you there was a way to get those cheap Costco gas prices — or something pretty close — without needing a membership, waiting in line or constantly checking an app?

We crunched the numbers, and it turns out many stations located near a Costco will price their gas just as low to compete. They know they'll lose business if their price is way higher than Costco next door, so to keep up, they price match — or at least come very close.

That means you can often fill up at a nearby station for nearly the same price, or sometimes even less, without a Costco membership or waiting in a massive line. Plus, you can still collect your loyalty points and take advantage of amenities like car washes and convenience stores, which Costco gas stations don't have.

How it works

Gas stations in Canada generally set their prices based on a combination of supply and demand, crude oil prices and nearby competition.

As the Competition Bureau explains, gas stations "strive to meet or beat their competitors' posted prices," which is why it's common to see "two neighbouring gas stations charging identical prices."

So if a Costco is selling gas at a steep discount, nearby stations tend to follow suit — at least somewhat — to stay in the game. That means you should be able to get near-Costco pricing without dealing with Costco-sized lineups or needing a membership.

To test this theory, we did a deep dive into Costco gas prices, comparing them to nearby stations using GasBuddy, a crowdsourced app where people share real-time gas prices.

And while there were a few exceptions — especially in regions like Quebec and the Atlantic provinces, where GasBuddy data is limited — the pattern was clear in most cities: If there's a Costco, there's often a competitively priced station nearby.

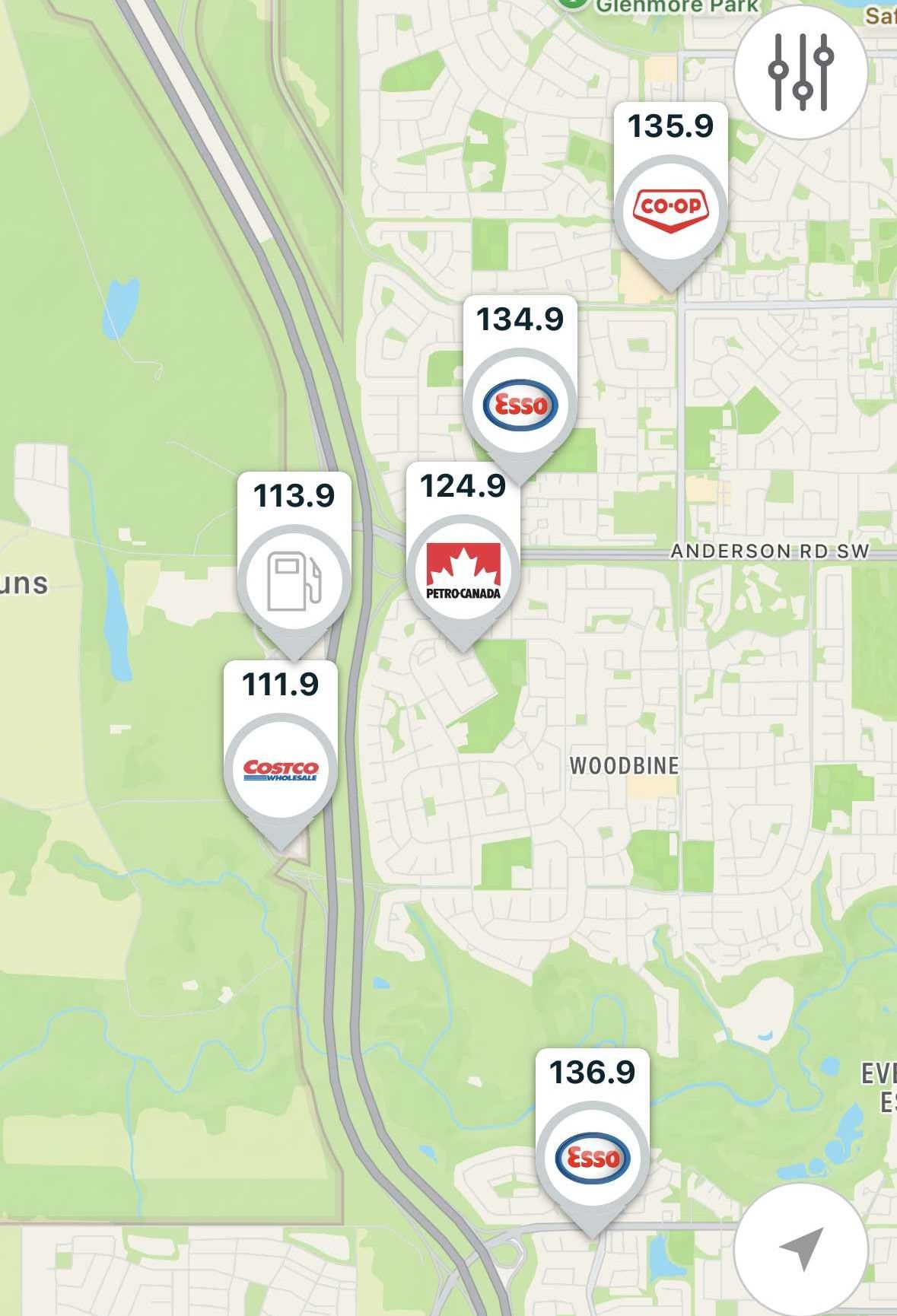

Take this Costco in southwest Calgary for instance — at the time of writing, the price here was 111.9 cents per litre. Just across the road, Tsuut'ina Gas Stop was at 113.9, only 2 cents higher. Meanwhile, a Petro-Canada on the other side of a major highway was charging 124.9.

Go a bit farther, and prices at other stations jump to 134.9 and even higher. That means by filling up at Tsuut'ina next to Costco, you'd be saving over 20 cents a litre — and skipping the Costco lines.

And if that's not enough, sometimes the competition gets even more intense.

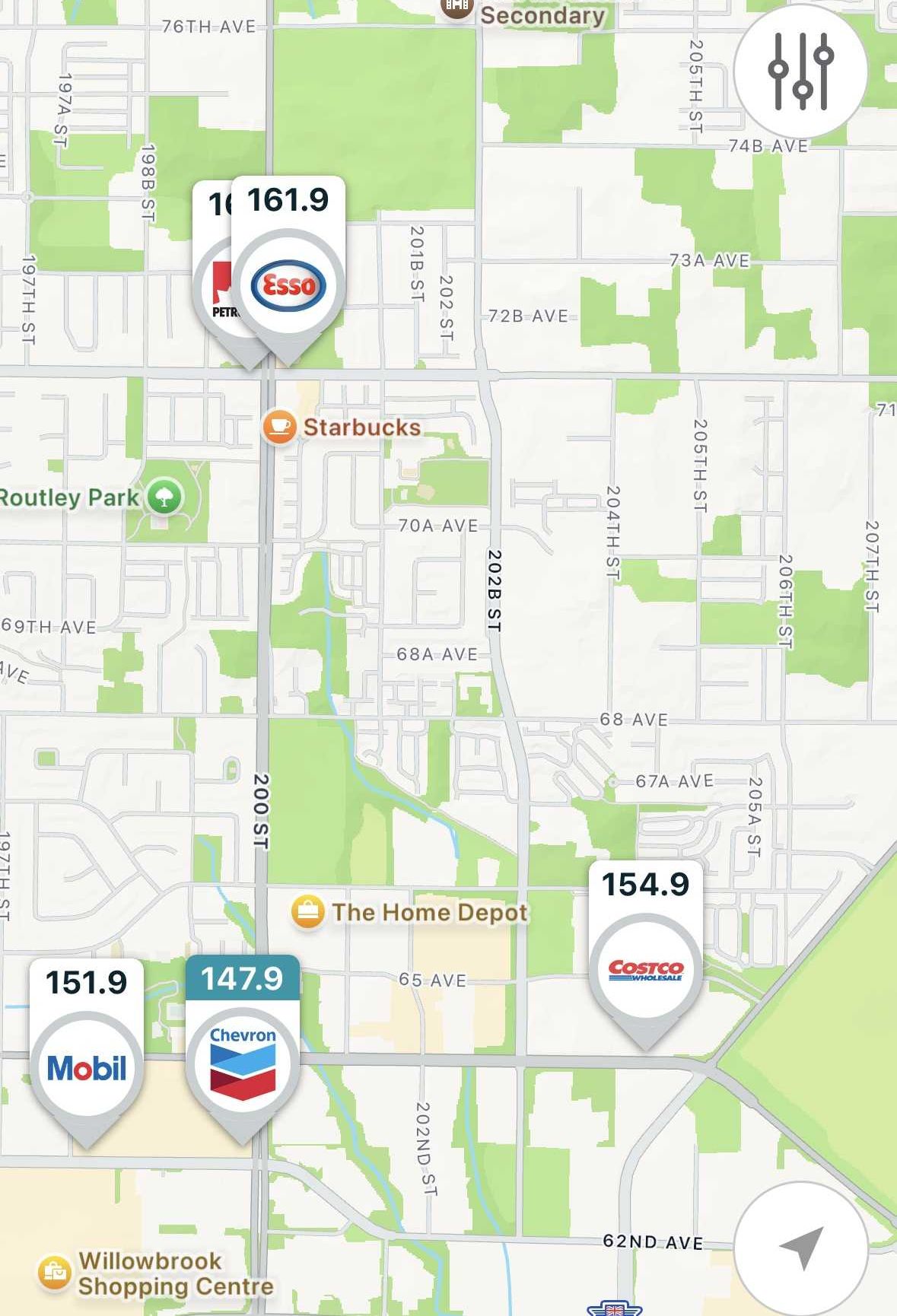

As you can see in this example, a Chevron station down the street from the Costco in Langley, B.C., actually undercut the warehouse price.

Costco had gas at 154.9 cents per litre, but Chevron was down to 147.9. That's 7 cents cheaper than Costco — and a full 14 cents cheaper than an Esso and a Petro-Canada just a few blocks away, both of which were charging 161.9.

In this case, you'd save more by not going to Costco.

So while Costco gas stations are consistently cheaper overall, they aren't always the very lowest in the area. Sometimes, the draw of Costco is so strong that nearby stations drop their prices even lower just to stay competitive and avoid losing customers.

We came across this in multiple areas, including around the Newmarket and North Mississauga locations.

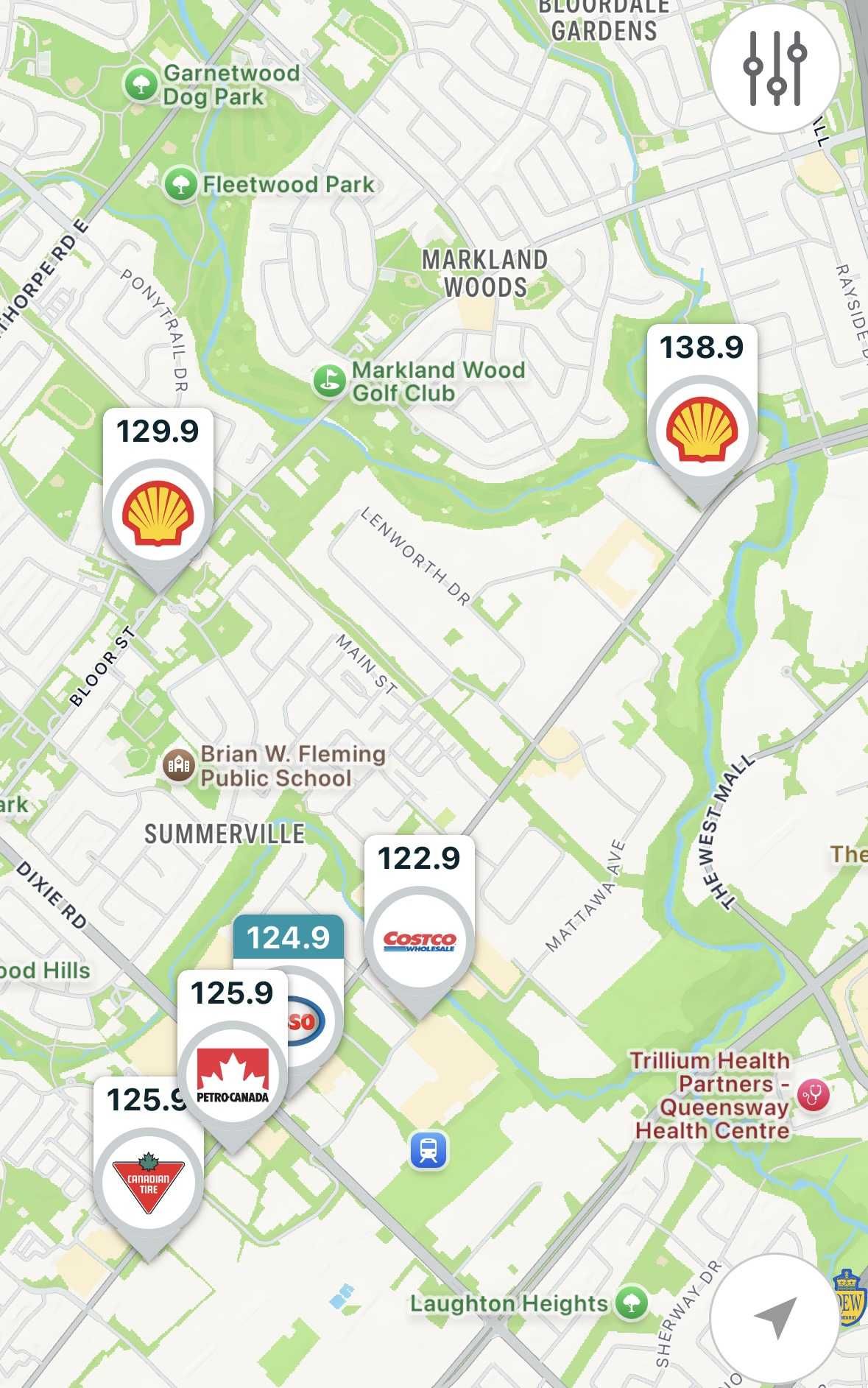

You can see in this example how prices seem to get progressively higher the farther away from the Costco they are. At the time of writing, the Costco in central Mississauga was selling gas at 122.9.

A block or so away, an Esso was charging 124.9, and another block farther, a Petro-Canada and Canadian Tire Gas+ were a cent higher at 125.9. Go a little farther and prices spiked — one Shell station was charging 138.9.

Filling up at any one of those stations along Dundas means a solid 13 to 14 cents in savings compared to a typical fill-up elsewhere in the area. And again, just 2 cents higher than Costco, with no membership needed.

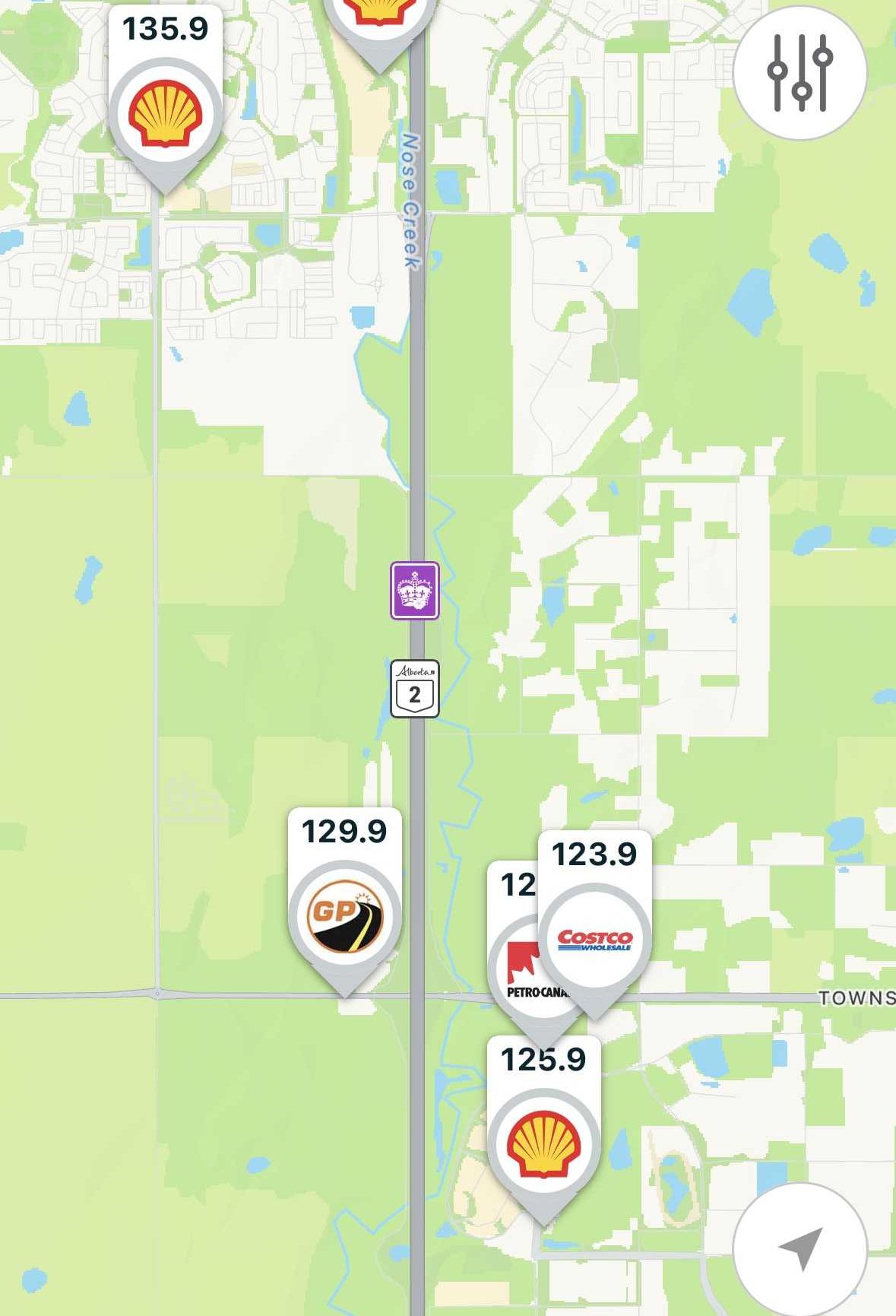

Same deal in this example north of Calgary in Rocky View — the closer you are to Costco, the lower prices dip.

Here, the Petro-Canada right next to Costco was priced at exactly the same rate — 123.9. A Shell nearby was 2 cents higher, while the Gas Plus across the highway climbed by another 4 cents.

Meanwhile, the next-closest stations up the road in Airdrie were priced around 135.9. That's a 12-cent saving, just by knowing where to look.

As you can see from these examples, the hack isn't limited to any one city or province — theoretically, it works anywhere in Canada where there are competing gas stations near a Costco one.

So how do you take advantage?

Here's the easiest way to do it:

- Find your nearest Costco gas station. Even if you're not a member, you can check the price on websites like GasBuddy or drive by and look out for an A-frame sign out by the entry to see what they're charging.

- Look at the surrounding stations. A lot of the time, there'll be a competitor within a block or two trying to keep up. Have a look around at who has the best deal — you should really only need to do this once.

- Compare once, then commit. Once you've found the best dupe for Costco gas near you, just make it your go-to spot. Chances are, if they're competing with Costco when you find them, that's part of their regular business model. No app required.

We found that this trend held up across much of Canada, but like anything, it's not a perfect system.

GasBuddy data is thinner in places like Quebec and the Atlantic provinces, so it's harder to confirm in those regions — which is where driving by your nearest Costco to check for yourself comes in. But overall, it's a surprisingly consistent trick.

If you're already a Costco member, this trick can still come in handy. When the lines are out of control or you're short on time, it's good to know you've got options nearby with nearly identical prices.

And if you're not a member, you can finally let go of that FOMO and just fill up next door.

What's your go-to gas strategy?

READ NEXT: Esso vs. Shell vs. Petro-Canada: Here's which gas station has the best loyalty program in 2025

These prices are intended as an example only. They are confirmed at the time of publishing, but they can change at any time.