Everything you need to know about gas prices & rebates now the consumer carbon tax is dead

Mark Carney killed the tax. But will it rise from the dead?

When are gas prices going down? Are we still getting an April rebate payment? All your questions, answered.

If you've been following the carbon tax news and wondering what it means for gas prices or that sweet carbon rebate cheque, here's where things stand — and how it's all about to hit your wallet.

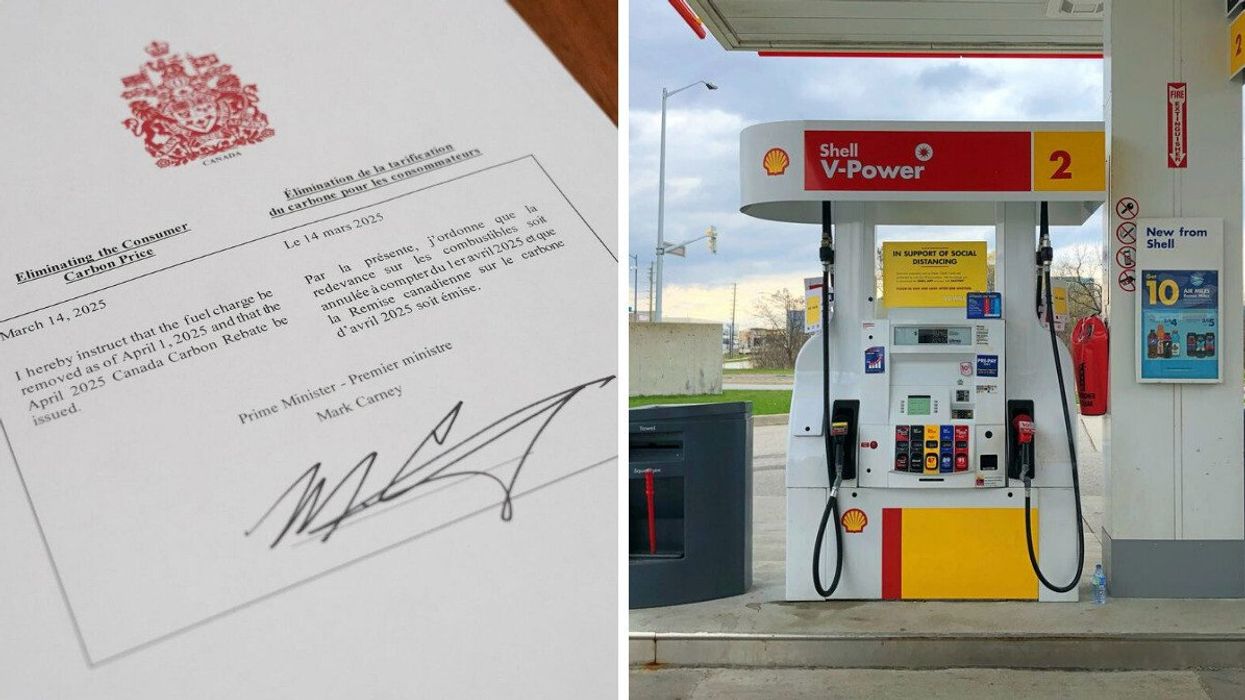

Just hours after being sworn in as Canada's 24th prime minister on Friday, Mark Carney made his first official move, and it was a big one: scrapping the consumer carbon tax.

The federal carbon pricing scheme was first introduced by former prime minister Justin Trudeau in 2019 as a way to put a price on pollution and help Canada lower its emissions. The idea was to make fossil fuels more expensive so people and businesses would switch to greener energy.

To balance the costs for everyday Canadians, the federal government gives out quarterly rebates through what's now called the Canada Carbon Rebate.

But over time, the carbon tax has become less and less popular. Conservative Leader Pierre Poilievre's pledge to "axe the tax" has been gaining traction with voters as daily necessities keep getting more expensive, and even within the Liberal Party, support for the policy was wavering.

Carney himself had supported carbon pricing in the past, but during his leadership bid, he called the current policy "too divisive" and promised to kill it. Now that he's in charge, he wasted no time following through.

But what exactly happens next? Can Carney actually kill the tax while Parliament is still prorogued? When will gas prices go down? Will the carbon tax rebate still land in your account next month? And is this really the end of it, or just temporary relief before more changes? Let's break it all down.

What exactly is the carbon tax?

Carbon pollution pricing — also known as the carbon tax — is part of a broader effort to reduce greenhouse gas emissions in Canada. The idea is to make carbon-emitting products more expensive to encourage people to use less and push companies to offer more climate-friendly alternatives.

Officially implemented in 2019 after Justin Trudeau's government passed the Greenhouse Gas Pollution Pricing Act, it has two parts: a federal fuel charge on fuels like gasoline, diesel and natural gas, and a separate system for large industries.

When people talk about the "consumer carbon tax," they're referring to the first piece — the federal fuel charge.

The federal fuel charge is revenue neutral, meaning that all money collected is returned to the province or territory it's from. Most of the proceeds are sent directly to Canadians through quarterly Canada Carbon Rebate payments, and the rest is distributed to farmers, Indigenous governments and small- and medium-sized businesses.

Provinces and territories are allowed to implement their own pollution pricing systems as long as they meet the benchmark set by the federal government — otherwise, they can simply use the federal system. Currently, only three jurisdictions use their own fuel charge system instead of the federal one — B.C., Quebec and the Northwest Territories.

Is the carbon tax actually dead?

Yes... and no. Prime Minister Mark Carney's order-in-council on Friday put an end to the consumer-facing federal fuel charge, but the federal industrial carbon tax on large emitters will remain in place.

The government says it is "refocusing pollution pricing on industrial carbon pricing by effectively eliminating the fuel charge and removing the requirement for a consumer carbon price," according to an amendment to the Greenhouse Gas Pollution Pricing Act published on Saturday. This means that rather than removing the tax altogether, the feds are shifting the responsibility for paying it onto industrial polluters, rather than consumers.

Despite Parliament currently being prorogued, a Department of Finance official confirmed to Narcity in an email that the order Carney signed was valid and that the fuel charge would end right away on April 1, even if Parliament hasn't returned yet by then.

"An Order in Council is a formal, legal instrument, signed by the Governor General, that implements decisions made by the federal cabinet," a Finance Canada spokesperson explained. "Orders in Council do not need to be tabled in Parliament in order to be effective."

They confirmed that all fuel charge rates will be set to zero, and administrative rules like registration and filing requirements will end.

That means starting April 1, you'll no longer be paying the extra charge to fill up your gas tank or heat your home. However, the separate industrial carbon pricing system will stay in place — which affects prices across many industries.

What does this mean for B.C., Quebec & the Northwest Territories?

Because B.C., Quebec and the Northwest Territories have their own carbon pricing systems, federal changes don't automatically apply.

In B.C., Premier David Eby announced on Friday that the province will move quickly to repeal its own consumer carbon tax now that the federal requirement is gone. He announced that his government was preparing legislation to repeal the tax and eliminate the scheduled increase that was set for April 1 of this year.

In the Northwest Territories, the government is also scrapping its consumer carbon tax, following the federal decision. CBC reports that the territory can't formally repeal its tax law right now because the legislature isn't in session, but it will set the tax value to zero starting April 1 — effectively ending it. Residents there will still get one last cost of living offset (COLO) payment in April, but like the federal rebate, that'll be the end of it.

As for Quebec, no announcements have been made about scrapping that province's carbon pricing. For now, it looks like the system will stay in place.

Will gas prices in Canada go down?

Expect a drop — but how much depends on where you are, what type of fuel you use and other factors.

"While the government doesn't control prices at the pump, we can confirm that the current fuel charge rate is 17.61 cents per litre of gasoline in jurisdictions where the fuel charge applies," a Department of Finance official told Narcity. "That charge will be removed on April 1st, 2025."

That said, there's a lot more that goes into gas prices in Canada beyond the consumer carbon tax, so the exact drop might vary. For example, the switch to summer-blend gasoline — a more expensive fuel that runs more efficiently in warmer temperatures — is set to hike prices up by about five to six cents a litre around the same time, gas analyst Dan McTeague told Narcity.

Still, most Canadians — with the exception of those in Quebec — should see a noticeable difference on April 1.

What's happening to the Canada Carbon Rebate?

The Canada Carbon Rebate is a federal quarterly payment sent out to residents in the provinces where the federal fuel charge system is in place — Alberta, Manitoba, New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario, P.E.I. and Saskatchewan. It offers up to $540 per quarter for a family of four, although amounts vary depending on where you live.

Because its purpose is to send back the money that the government collected through the consumer carbon tax, there's one more payment coming — and then it's over.

The government has confirmed that the final Canada Carbon Rebate payment will be sent out starting April 22 — a week later than it was originally scheduled for on April 15.

However, there's a catch: In order to get it by that date, you'll need to file your 2024 tax return electronically by April 2. If you file later, you'll still get the money, just a bit later — usually within six to eight weeks of the CRA processing your tax return.

A Department of Finance official confirmed to Narcity that "proceeds return mechanisms like the Canada Carbon Rebates for individuals will be wound down accordingly," meaning this will be the last payment. So if you've been counting on those quarterly deposits, April is the final one.

Is the carbon tax cut permanent?

That's the million-dollar question. Depending on who you ask, the answer isn't so straightforward — and it might not be what you want to hear.

Dan McTeague, President of Canadians for Affordable Energy, told Narcity that he doesn't believe Canadians will see any permanent relief under a Carney government. "Although it may be welcome news to people, it really depends who forms government," McTeague said.

He explained that unless Pierre Poilievre's Conservatives — who have pledged to repeal the entire Greenhouse Gas Pollution Pricing Act and permanently axe the tax for everyone, including industrial emitters — win a majority in the next election, Canadians will "continue to have a carbon tax at these levels, one way or another, going up every year until 2030."

McTeague, who served as a Liberal MP for 18 years, explained that as Carney hasn't announced any intentions to repeal the Act, the pollution pricing target of $170 a tonne "is either going to be met by a consumer carbon tax or an industrial one."

So, while the consumer carbon tax might never return in name, McTeague says pollution costs will inevitably be passed down to Canadian consumers through the industrial tax instead. "What's going to happen is that businesses will absorb it and pass it right on to consumers," he explained.

"Either way, you're going to pay for it."

- Mark Carney just axed the carbon tax — Here's what happens to the April rebate payment ›

- CPI in Canada keeps rising but these items are inflating WAY faster than others - Narcity ›

- 7 government benefit payments you can get from the CRA & Service Canada in April 2025 - Narcity ›

- Gas prices will drop next week thanks to the carbon tax — but not by as much as you think - Narcity ›

- The final Canada Carbon Rebate payment is coming soon — but only if you do this first - Narcity ›

- Gas prices are dropping tomorrow across Canada — but it won't last long - Narcity ›

- Canada Carbon Rebate for April goes out soon and the final payments have a little extra - Narcity ›

- Canada Carbon Rebate payments just went out but here's why you didn't get yours yet - Narcity ›

- Gas prices are going up tomorrow across Canada but here's which spots have the savings - Narcity ›

- You might owe the CRA money back for the Canada Carbon Rebate — Here's how to find out - Narcity ›

- Gas prices in Canada are swinging hard tomorrow — Here's where to fill up now vs. wait - Narcity ›

- Gas prices are going up tomorrow across Canada but here's where you can still get it cheap - Narcity ›

- Is a Costco membership worth it for gas alone? We did the math - Narcity ›

- Gas prices are dropping tomorrow across Canada and these spots will have the biggest savings - Narcity ›

- Gas prices in Canada are rising sharply tomorrow but one spot is currently under $1/L - Narcity ›

- Gas prices tomorrow are up & down across Canada — Here's where to fill up or wait it out - Narcity ›

- Gas prices in Canada are rising by up to 21 c/L tomorrow but here's where to find the savings - Narcity ›

- Gas prices in Canada are dropping in a bunch of cities tomorrow — but rising in a few others - Narcity ›

- Canada's Budget 2025 could trigger another election this fall — Here's how it works - Narcity ›