However, it's not all bad news. Housing prices across the country vary dramatically, with places like British Columbia and Ontario requiring much higher incomes, while provinces like Newfoundland and Labrador or New Brunswick are far more affordable.

New research from weathvieu.com has compared the salary needed to afford a home in every Canadian province to determine whether any of them can actually be considered affordable.

To work this out, weathvieu started with the average home price in each province in August 2024 and calculated the total mortgage amount by subtracting a 20% down payment from the home price, which helps avoid the cost of CMHC insurance.

Then, they calculated the mortgage payments using a 5-year fixed mortgage rate of 6.50% over a 25-year amortization. To ensure the home was affordable, they used the 28/36 rule, which suggests that no more than 28% of your gross monthly income should go toward housing. This method provides a clear picture of the annual salary needed to comfortably afford a home in each province.

So, what's the verdict? Well, as you can imagine, there's a lot of bad news.

Starting with the most expensive: B.C., unsurprisingly, tops the list. The average home price in B.C. is a whopping $998,159 (O.M.G.), meaning you'd need an income of $229,231 a year just to get your foot in the door. Vancouver is largely responsible for these sky-high numbers, and it's no secret that the city's real estate market is out of reach for many.

Ontario is close behind with a sky-high average home price of $884,761, which means you'll need to make $203,189 annually to afford the average house cost in Canada's most populous province.

If you're looking in or around the Greater Toronto Area, those numbers might feel all too familiar.

The good news is that things do get more manageable in other provinces. Alberta, for example, offers much more affordable real estate compared to B.C. and Ontario. The average home price in Alberta sits at $503,502 as of August 2024, which means you'd need to bring in about $115,631 a year to comfortably afford a home. While Calgary and Edmonton have seen home prices climb, the rest of the province offers more flexibility for buyers.

Saskatchewan and Manitoba are also relatively affordable options. In Saskatchewan, the average home price is $332,413, so you'll need an income of $76,340 to cover mortgage payments. Manitoba is slightly more expensive, with an average home price of $383,396, meaning you'd need to earn about $88,048 per year to afford your own place.

Heading east, Quebec is on the higher side of affordability but still cheaper than B.C. and Ontario. With an average home price of $506,224, you'd need an income of $116,256 to buy a house here. Montreal's real estate market costs continue to rise, but there are still more affordable options outside of the city.

The real bargains are in Atlantic Canada. Newfoundland and Labrador is the most affordable region to buy a home in Canada, with an average property price of $318,631. That means you'd only need to earn about $73,175 per year to comfortably afford your mortgage payments, which is a breath of fresh air compared to the six-figure salaries required in other provinces.

The situation is also promising in New Brunswick, where an average home price of $329,307 would require an annual income of $75,627.

Prince Edward Island and Nova Scotia are slightly pricier than their Atlantic neighbours but still affordable compared to other parts of the country. In P.E.I., the average home price is $379,098, meaning you'd need an income of $87,061 per year. Nova Scotia's average home price is $460,753, so you'd need to make around $105,814 annually to afford a house there.

When comparing the annual income needed to the average household income for each province, six out of ten provinces can be considered "affordable": Alberta, Saskatchewan, Manitoba, Newfoundland and Labrador, New Brunswick, and P.E.I.

Unfortunately, British Columbia, Ontario, Quebec, and Nova Scotia are still out of reach for many.

While some provinces are considered more affordable by these calculations, it's important to note that even here, coming up with a 20% down payment is no small feat. If you're currently renting or most of your income goes toward essentials like bills and groceries, saving up for that deposit can feel almost impossible.

Another thing to consider is that these numbers reflect a single income. For those buying with a partner or co-buyer, combining incomes could make these homes more affordable. However, for solo buyers hoping to enter the housing market, it's an entirely different story. In provinces like British Columbia and Ontario in particular, the required salary far exceeds the average individual income, making it much tougher for anyone looking to buy a home on their own.

While owning a home in Canada may feel like a distant dream, there are still pockets of relative affordability across the country—you just need to know where to look!

AI tools may have been used to support the creation or distribution of this content; however, it has been carefully edited and fact-checked by a member of Narcity's Editorial team. For more information on our use of AI, please visit our Editorial Standards page.

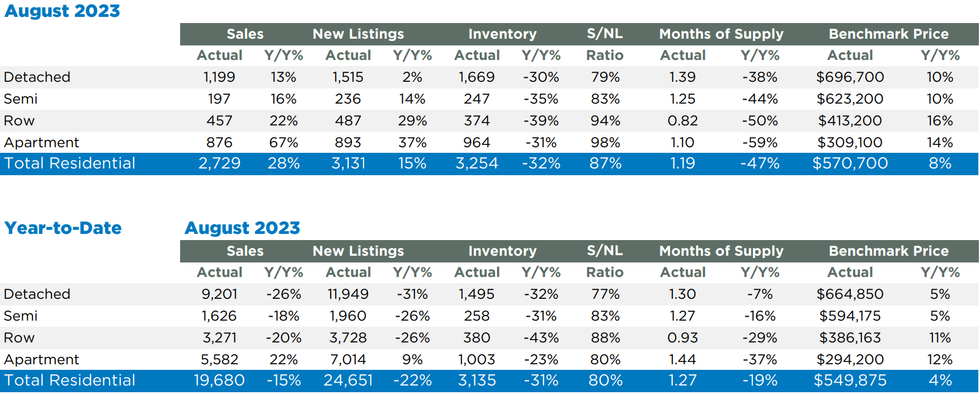

August 2023 Housing Statistics Tables from the Calgary Real Estate Board.

August 2023 Housing Statistics Tables from the Calgary Real Estate Board.