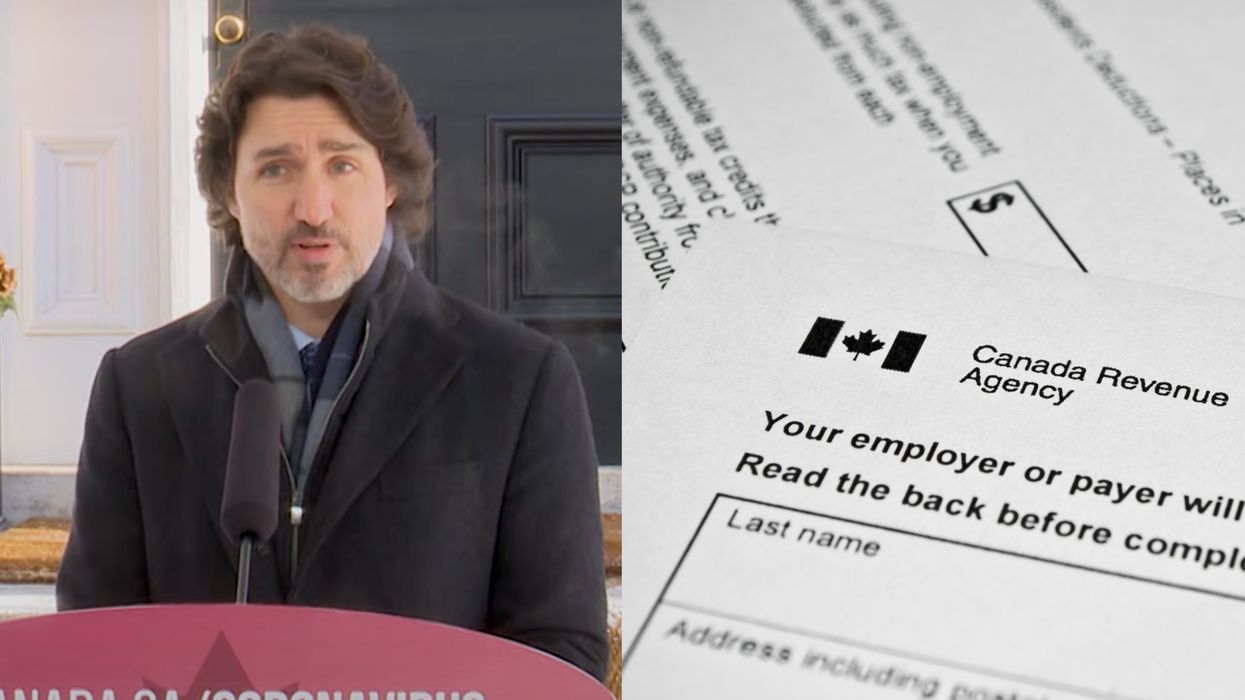

This Super Simple Video Explains Who Can Get Canada's New Relief For Tax Debt (VIDEO)

If you've been feeling a little confused about Canada's new temporary tax relief, this video should help clear things up!

On February 9, the federal government announced that Canadians who received COVID-19 benefits would be given an interest-free year to return any debt related to those benefits.

Editor's Choice: Trudeau Just Told Canadians Which Benefits To Apply For Depending On Their Situation

It’s a move designed to take the pressure off Canadians during tax time by giving them “more time and flexibility” to repay any money owed.

In a tweet about the announcement, Prime Minister Justin Trudeau explained, “The pandemic isn’t over yet, and neither is our support for you.”

“We’re providing one year without interest on certain 2020 tax debt — giving you more time to pay amounts you owe and making sure you can get back on your feet,” he added.

Alongside the message, he re-shared a video from Diane Lebouthillier, Canada’s minister of national revenue.

The 17-second clip explains who the interest-free tax break applies to and exactly which COVID-19 benefits a person must have claimed.

It also notes that claimants should have earned under $75,000 in taxable income last year to qualify.

According to a statement from the Canada Revenue Agency, once individuals have filed their 2020 income tax and benefit return, they won’t need to pay interest on any outstanding income tax debt for the 2020 tax year until April 30, 2022.

The interest relief measure will be automatically applied come tax time for eligible individuals who meet the criteria.