Ron DeSantis Has A Tax Relief Plan For Florida & Here's What You Can Save Money On This Year

It's family-focused but single individuals can save money too.

Ron DeSantis at a podium. Right: Ron DeSantis discussing his Tax Relief plan.

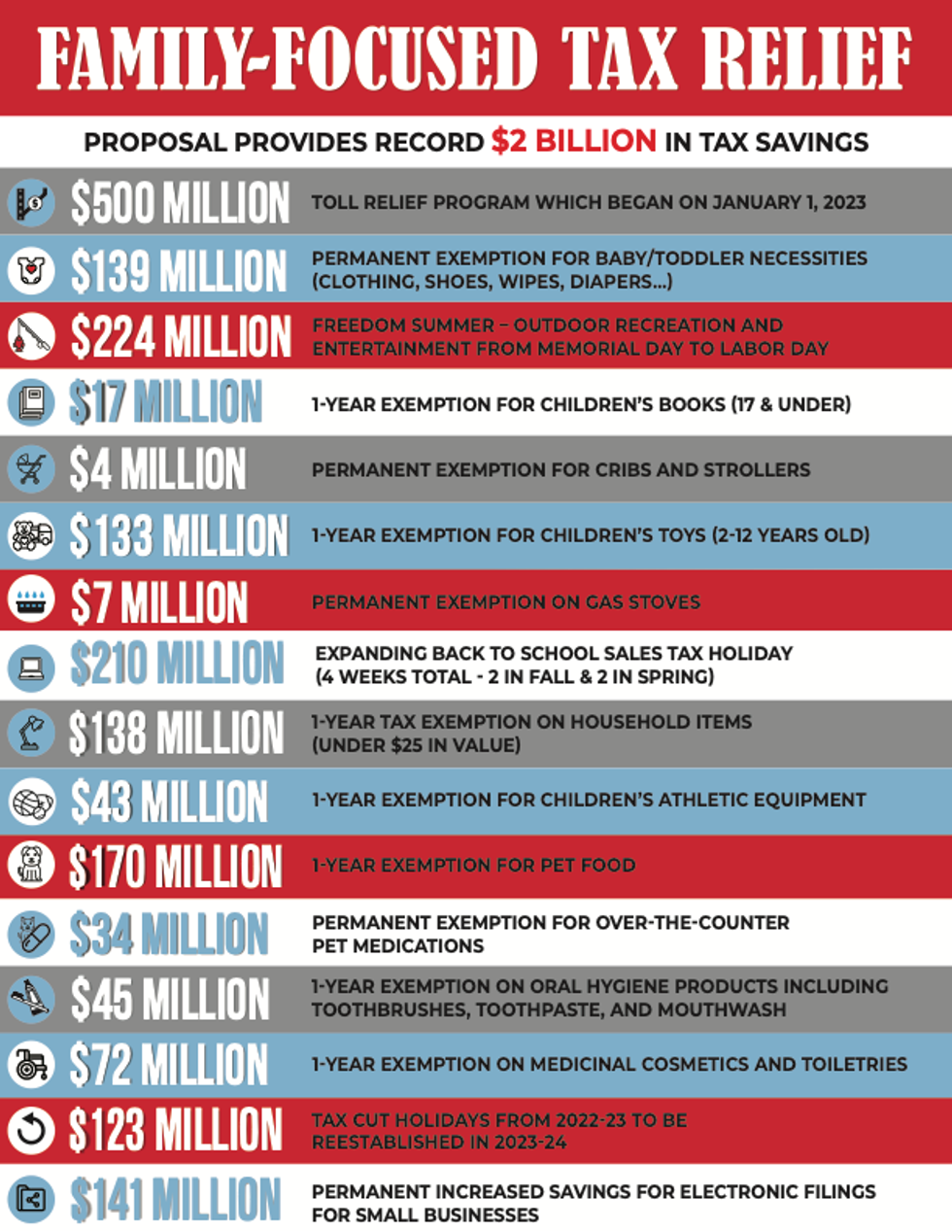

Governor Ron DeSantis is looking to move forward on a tax relief plan that promises to save Floridians so much money. His camp calls this proposal the "largest" one the state has seen and suggests there could be $2 billion in tax savings.

The governor was in Ocala, Florida, to address his intentions with the plan, which looks to be overall family-focused. However, the plan appears to include benefits for single individuals too. The governor's proposal looks to exempt a year of sales tax for "children's items" as well as introduce "a permanent sales tax exemption on baby and toddler necessities."

According to the Governor's press release, "the average Florida family could save up to $1,000 a year under this plan."

Aside from tax exemptions on childcare goods, the plan includes proposed exemptions (some permanent and some for 1 year) for household items under $25, pet food, oral hygiene products (including toothbrushes, toothpaste, mouthwash), medicinal cosmetics and toiletries.

In addition to the suggested one-year sales tax exemption on pet food, DeSantis lists a permanent exemption for "over-the-counter pet medications" in the plan.

The governor also hopes to move forward with "permanent increased savings for electronic fillings for small businesses."

Last year, the Florida politician implemented a "tax-free summer" by lifting the sales tax on certain recreational products, activities and entertainment events, like concerts; he hopes to have this again in 2023-2024 by running a "Freedom Summer" tax holiday between "Memorial Day to September 4."

DeSantis hopes to also expand the "Back to School" tax holiday which was introduced in 2022.

According to the proposed programs, it looks like families could see the most benefit as the governor also suggests implementing a year of tax-free children's books for those under the age of 17, this would apply as well to children's athletic equipment.

This plan is suggesting nearly one billion dollars in additional tax savings compared to the previous "1.1 billion" outlined in the plan DeSantis proposed back in September 2022.