A Study Shows How Ontario Housing Prices Compare To Millennial Salaries & It's A Big Yikes

Here's how many years it'll take to save up that down payment. 👇

Condos in Toronto.

Dreams of home ownership have continued to fade for young people as they've watched GTA Housing Prices spike out of control and a new study shows just how tough it is for millennials to enter Ontario's housing market.

Facing an already high cost of living, the study compared how housing prices have climbed over the years in comparison to the typical salary for a millennial, which hasn't changed much at all.

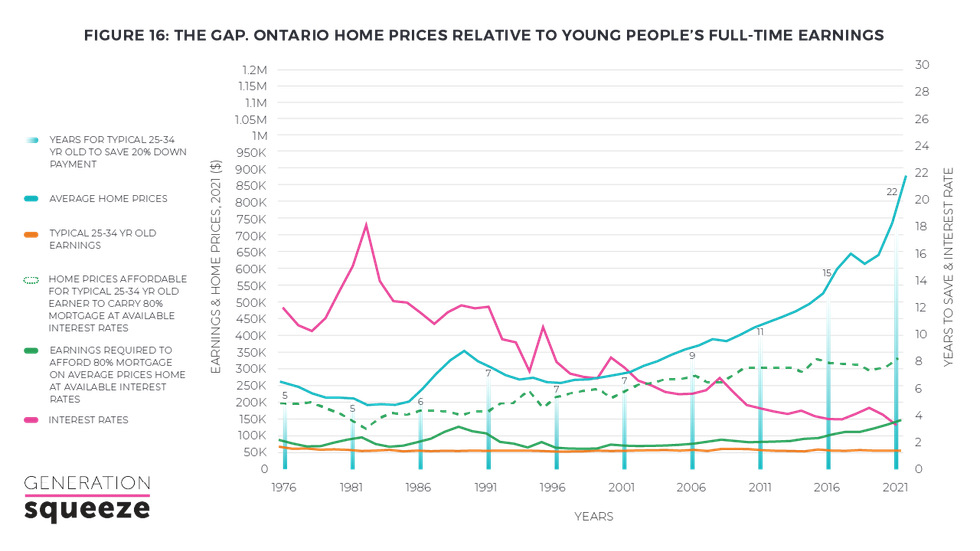

The Straddling the Gap 2022 Report by Generation Squeeze compared the typical salary for someone between the ages of 25 and 34 to the average price of a home from 1976 all the way up to this year and it's another tough pill for aspiring homeowners to swallow.

The study revealed as the typical salary for a millennial in Ontario has hovered around $50,000 for decades, the average price of a home has ballooned up to nearly $900,000.

"Average home prices would need to fall $530,000 – over 60% of the 2021 value – to make it affordable for a typical young person to carry a mortgage," read the report. "Or typical full-time earnings would need to increase to $137,000/year – over 150% more than current levels."

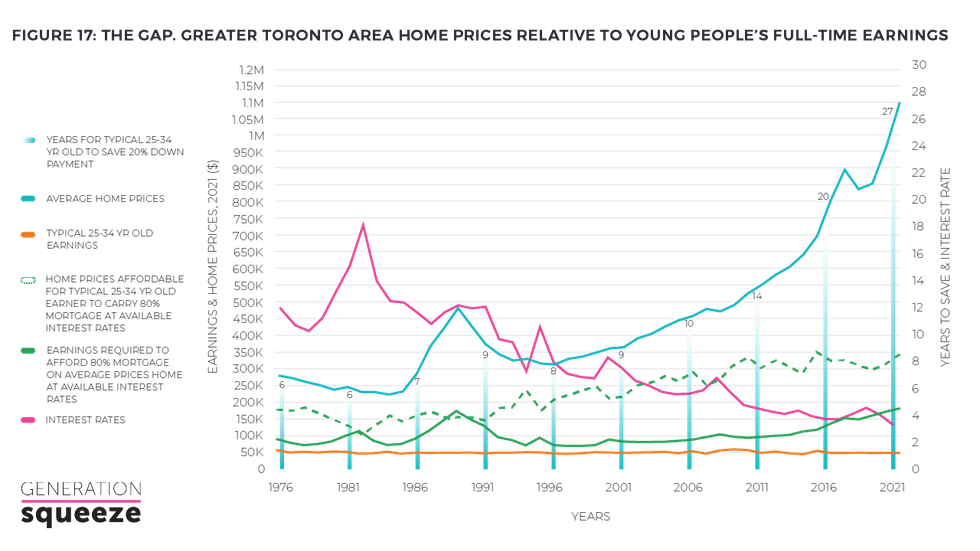

The Ontario statistics pale in comparison to the reality of the GTA housing market, where the average price of a home is around $1.1M, while annual salaries for millennials have continued to hover right around $50,000.

Generation Squeeze

"It takes 27 years of full-time work for the typical young person to save a 20% down payment on an average priced home – 21 more years than when today’s aging population started out as young people," the report said.

Understandably, the numbers have generated some painfully honest reactions online.

"That graph is depressing AF," wrote one person on Reddit.

Another commenter highlighted how the issue stretches far past just the typical "average" salary.

"I make a decent amount more than the median income in this city and still have no hope of purchasing a property outside a shoebox condo with a microwave for an oven," he wrote.

Others joked the report shows it's time to move, noting the particularly cheaper housing costs, higher salaries, and therefore better affordability in Alberta.

"If you somehow manage to save three quarters of your paycheque every week for ten years, you might not actually be further away from being able to make a down payment by then," someone else said in the comments.

Unfortunately, that isn't too far off from reality.

How long does it take to save up for a house in Canada?

According to this study, it would take roughly 17 years to save for a 20% down payment in Canada today.

That apparently adds up to giving up 19 lattes a day, every day, for five years for someone living in Ontario. That jumps to 24 in the GTA.

But even though it may seem all doom and gloom, there are some things to be hopeful about.

Toronto's housing prices are forecasted to drop in 2023 and the study encourages people to normalize some of these very real struggles about the time it takes to save for a home so that it becomes a much bigger topic of concern for government officials.

If all else fails, just be patient and remember you aren't climbing the massive mountain of affordability alone.