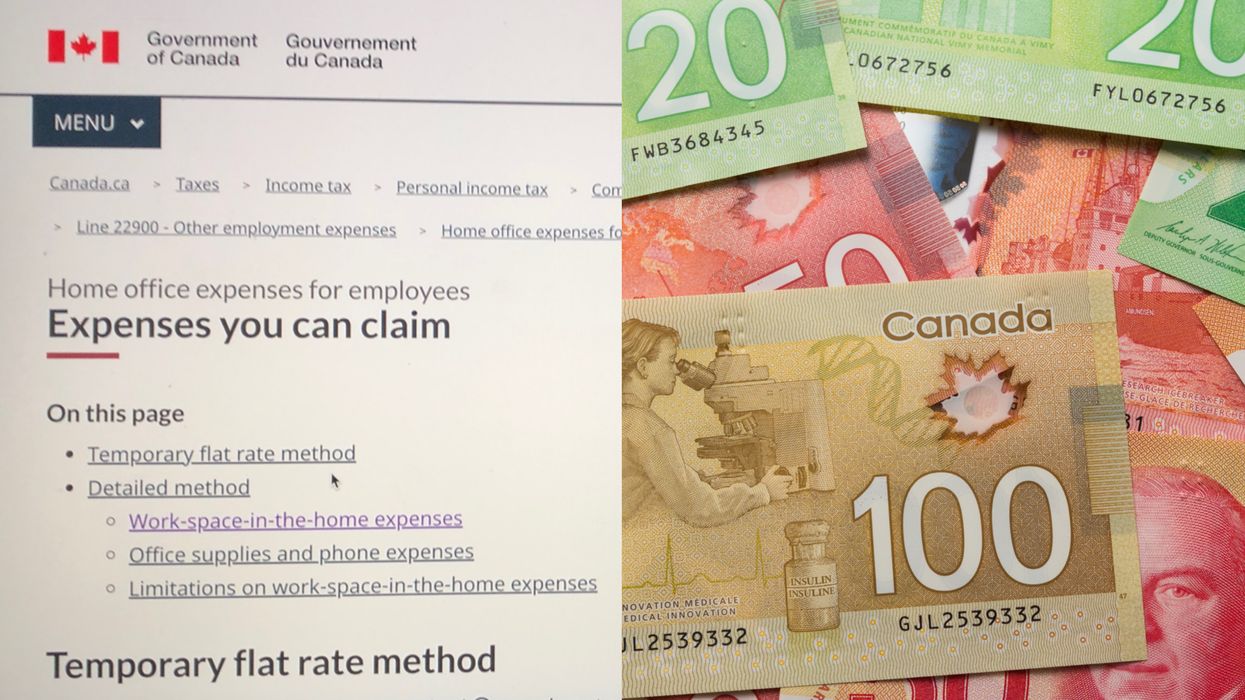

Here’s Everything You Need To Know About Canada’s Work From Home Tax Deduction

To support Canadians who have been staying away from the office during the COVID-19 pandemic, the federal government is offering a new work from home tax deduction.

Here’s everything you need to know about the tax deduction itself, eligibility, and exactly what you can claim.

Editor's Choice: Canadians Keep Taking Vacations Abroad During The Pandemic Against Official Advice

How does it work?

Back in December, the federal government acknowledged that many Canadians had been “unexpectedly” forced to set up their workspace in kitchens, bedrooms and living rooms due to the COVID-19 pandemic.

In response, the Canada Revenue Agency (CRA) made the home office expenses tax deduction available to more people.

In addition, the process for claiming these expenses on personal income tax returns was made easier.

The new (temporary) “flat rate method” allows eligible Canadians to claim a deduction of $2 for each day they worked at home.

This can be claimed up to a maximum of $400.

Who is eligible?

To be eligible to claim via the new “flat rate method,” Canadians must have worked from home more than 50% of the time for at least four consecutive weeks in 2020.

It's primarily available to those who have been asked to stay at home by an employer, but the CRA will also consider applications if it was a personal choice, too.

Applicants must only be claiming home office expenses and cannot be claiming any other employment expenses.

You are not eligible for the tax rebate if your employer is already covering your work from home expenses.

These criteria are a little different for those claiming via the "detailed method."

What can you claim for?

If you don’t think $2 per day covers your expenses, or your costs are a little more complex, you can claim by using the “detailed method.”

The Government of Canada has a list of approved expenses that can be deducted this way, too.

This includes electricity, heating, water, the utilities portion (electricity, heat, and water) of condo fees, internet access fees, maintenance and minor repair costs and even “rent paid for a house or apartment where you live.”

However, things like mortgage payments, furniture and wall decorations are not included.

Simplified online forms have now been created to help employers and workers navigate this claiming process.