Here Are 4 Major Canadian Cities Where You Can Apparently Buy A Home For $600K Or Less

No need to take out a million dollar mortgage in these spots!

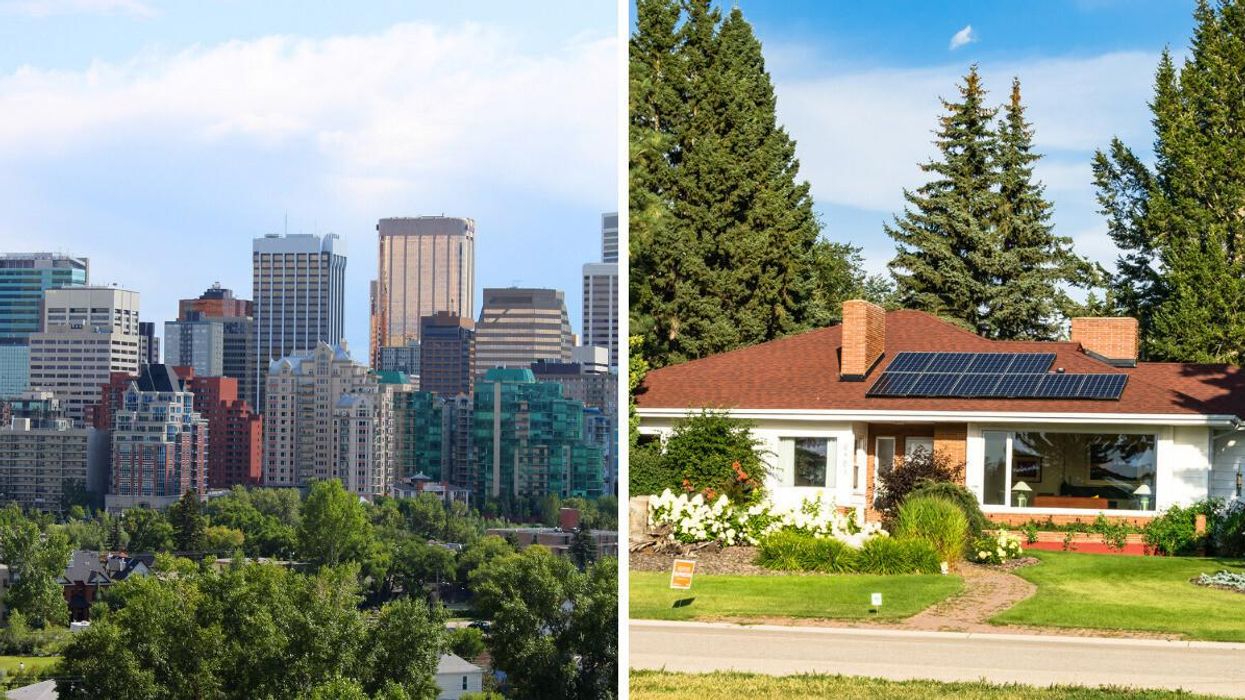

Downtown Calgary. Right: A house is Edmonton.

Depending on where you live, buying a house in Canada might feel like a pipe dream. But, there are cities across the country where the average sale price of a home is actually below $600,000.

According to a study conducted by real estate company SaveMax, there are a few major Canadian hubs where homes are being sold for less than a bank-breaking amount.

By analyzing the average sale price of homes in March, in cities such as Toronto, Calgary, Montreal and more, the company found that, of the spots listed, Winnipeg had the lowest house prices.

With homes selling for an average price of $401,047 in the Manitoban capital, it seems your dollar will probably go a lot further there than a lot of other places in Canada

The second cheapest place listed is Edmonton, where properties cost $414,788 on average in March.

After that comes Calgary, with an average selling price of $538,283 during the same period.

The final spot with homes selling below $600,000 is Montreal, where folks paid $587,415 on average for a property in March 2022. It's not bad going, considering this is Canada's second-most populated city.

From there, things start to get more expensive. The next three spots are Ottawa ($757,225), London ($823,954) and Hamilton ($1,105,797).

And, unsurprisingly, the city with the highest average sale price of a home in March 2022 is Toronto, with a spicy average selling point of $1,299,894.

Based on this research, it seems that southern Ontario is really one of the most unaffordable places to buy a home in the country.

However, the study can't provide a full picture because they didn't supply comparative data for Vancouver, another city with a notoriously expensive housing market.

And while Toronto has the highest average home price, it's actually not the place with the biggest rate of increase. Matter of fact, that honour goes to the slightly cheaper city of London, which has seen an annual property price increase of 29.8%.

While the cost of a home continues to rise, at least there are a few places in Canada where you don't have to sell a kidney to own the roof over your head.

This article's cover image was used for illustrative purposes only.