There’s A No-Fee Chequing Account In Canada & You Can Get Cash Back On Everything You Buy

Saving money doesn't have to be frustrating.

If there's one thing that can make life difficult, it's banking. How many accounts should you open? Who has the best interest rate? What are the different types of savings accounts and which one is right for you?

If banking has always felt like an overwhelming topic for you, then it might be time to consider an alternative option.

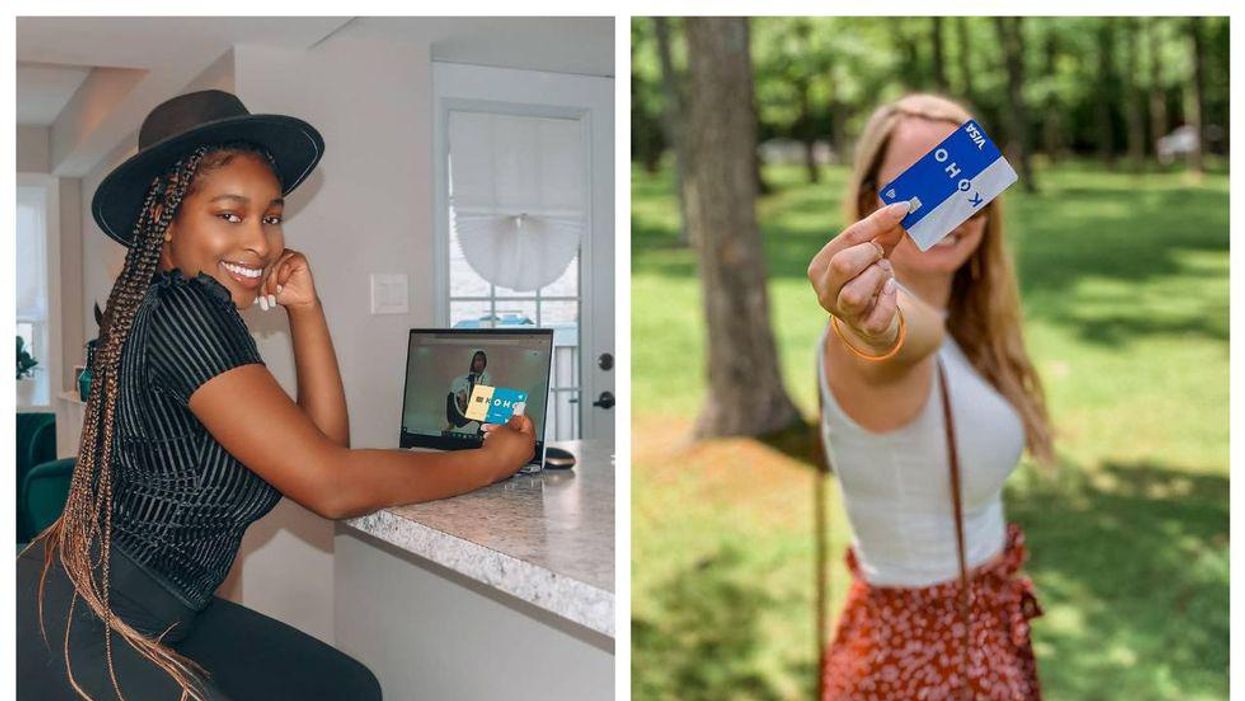

KOHO, for example, is a Canadian fintech company with a mission to democratize anything to do with personal finances, from financial literacy to providing money-saving tools. It all starts with a free chequing and savings account, which is connected to a reloadable prepaid Visa card and a user-friendly app. Together, they're designed to help you save faster, spend smarter, and budget better.

KOHO isn't a bank — in fact, it's proud to be quite the opposite. Boasting no hidden fees and no complicated jargon, KOHO is a "no-BS" banking alternative that offers simple financial products that help you live a better life by making day-to-day finances stress- and fee-free.

A huge part of KOHO's product offering is theirapp, which comes with tons of useful financial tools to get you budgeting like a pro.

If you like to put away your spare change for a rainy day, you might like the "RoundUps" feature. As its name suggests, it rounds up your every purchase to the nearest $1, $2, $5 or $10, then sends those "RoundUps" straight into your savings.

In the app, you can also build your credit score, set up savings goals, set up payroll, pay your bills, create a joint account, transfer money and more — right from your phone. KOHO's mission is about providing transparency, so there will never be any hidden fees.

As for extra perks, KOHO's cards deliver a minimum of 0.5% instant cashback on all purchases. For $9/month or $84/year, their Premium account earns you 2% cashback on groceries, transportation and dining out. You can also earn up to 12.5% cashback when you shop with KOHO's brand partners like Baskin Robbins, Frank and Oak, and Indigo as part of the "PowerUps" program.

And while many banks only reward you with interest on balances in your dedicated savings accounts, KOHO earns you 1.2% interest on both your spending and saving balances — which means you won't lose out on earning interest on your chequing account.

Perks aside, KOHO just makes banking super easy. The app is engaging, friendly and makes managing your finances something everyone can easily do — and in a way that feels customized to your individual banking needs.

KOHO's Banking Alternative

Price: It's free to sign up, and there are no hidden fees

Where: Canadians can start by simply downloading KOHO on their phones through the app store, or by visiting the KOHO website.

Details: Make saving easier with instant cashback, a 1.2% interest rate on every penny deposited into your KOHO account, and tons of useful financial tools in the KOHO app.

To learn more about KOHO's free chequing and savings account, visit the KOHO website or follow them on Facebook, Instagram, YouTube, and Twitter.

This content is for general informational purposes only and does not constitute financial, investment, legal, tax or accounting advice.