This Website Is Offering Canadian Students Free Financial Advice To Help Budget, Save And Spend Wisely

The pandemic has prompted the loss of summer jobs and, for recent graduates, it's instilled the fear of fewer career prospects. As a direct response to the unemployment faced by students and their general financial worries, the Canadian government implemented several different measures, including increasing the support available under the existing Canada Student Loans Program and introducing the Canada Emergency Student Benefit (CESB).

Whereas the usual summer for post-secondary students has consisted of working to save as much money as possible, this year hasn't exactly been the same. This is likely to have a big financial impact, especially on students who use the summer season to save for upcoming tuition and bills.

TD Canada Trust is offering a number of resources, including personalized advice and online tools, to support post-secondary students during this challenging time.

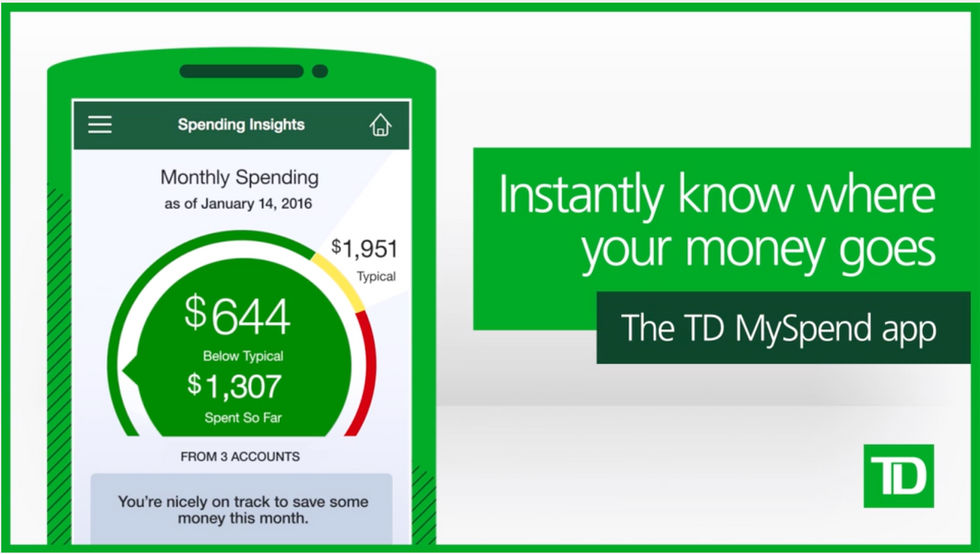

The situation could be an opportunity for students to reflect on their spending more critically than they have before, while some could be taking ownership of their finances for the first time. One of the digital tools TD offers to help customers track their spending is TD MySpend (available through the TD app), a money management tool that can help students stay on top of their spending through real-time tracking and goal-setting.

The app is designed to help determine where spending could be cut and identify small financial changes that help create a larger long-term impact — a really helpful skill, especially for students who might have less disposable income.

Plus, TD recently launched TD Ready Advice, a response to financial recovery from COVID-19. It provides customers, including students and recent grads, with relevant information, personalized advice, tips and resources to help them navigate through the current situation based on their specific needs and personal circumstances. This way, they can feel more confident about their financial future.

The initiative includes an online Ready Advice Hub, offering information on topics relevant to the challenges Canadians are facing. There are articles specifically for students, like “Some tips on what to do if you're a student financially impacted by COVID-19,” plus information focused on general financial advice, like “Good financial habits to develop.” This platform basically answers any question you might have and gives answers you didn't even know you needed.

If you're a student and need financial assistance, you can reach out and get connected with a TD Financial Advisor by making an appointment at your local branch online.