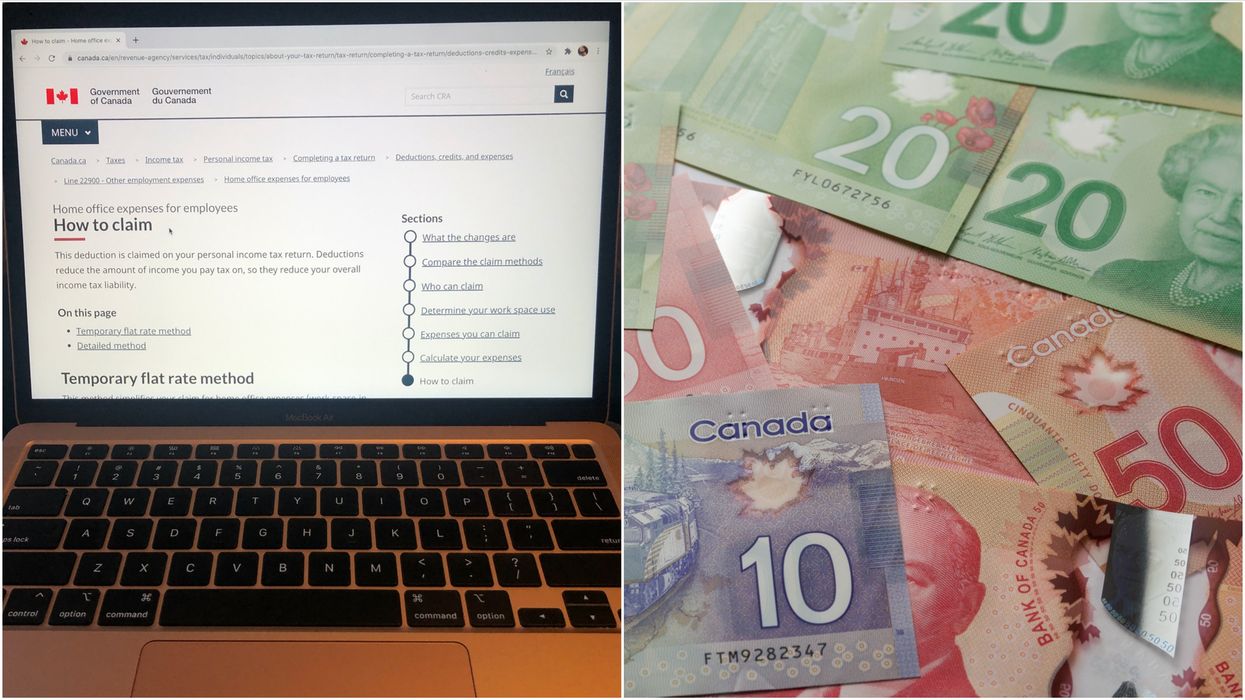

You Can Get Up To $400 For Working From Home During The Pandemic & This Is How

If you’ve been steering clear of the office recently, you could be eligible for up to $400 via the government’s work from home tax deduction.

At the start of this month, the government announced plans to give money back to Canadians who’ve been working from home during the COVID-19 pandemic.

Editor's Choice: Here's How You Can Get Cash From Canada's Class-Action Lawsuit Against Microsoft

On December 15, an additional statement was shared, providing more detailed information as to exactly who qualifies for the cash and how much is available.

Whether you’ve been working at home for four weeks or six months, you could be eligible to claim.

In fact, CBC News reports that “millions” of Canadians could receive a government payout.

With that in mind, here’s what you need to know:

How much can you get?

There are two different claim options on offer, the “temporary flat rate method” and the “detailed method.”

Eligible individuals claiming the first option will be able to claim $2 per day for every day worked at home, up to a maximum amount of $400.

Employers do not need to sign documentation to confirm this information.

For people with larger or more specific expenses, the CRA suggests using the "detailed method" to get deductions.

There’s a list of approved expenses that can be deducted via that method, including heating, electricity, water, home internet access fees and more.

Simplified online forms have been launched to help employers and workers navigate the claiming process.

Multiple people living at the same address can claim the money, as long as they all individually qualify.

Who can claim the money?

The federal government has laid out two different types of eligibility criteria.

Canadians who want to claim the "Flat rate method,” must have worked from home for over 50% of the time for at least four consecutive weeks during 2020.

Claimants are eligible if they were asked to stay at home by an employer, but the CRA will also consider their application if it was a personal choice, too.

Applicants must only be claiming home office expenses and cannot be claiming any other employment expenses.

An individual would not be eligible if their employer is currently covering all of their WFH expenses.

Criteria are slightly different for those claiming via the "detailed method."

How do you claim it?

Applying for deductions is pretty simple, according to the CRA.

Those using the standard method will need to confirm their eligibility online, then fill in a form detailing their information.

This will then be filed with their tax return.

Similarly, those using the alternative claim method will need to confirm they qualify before calculating expenses and filling out either the Form T777S or Form T777.

It will then be filed alongside the claimant's tax return, which the CRA recommends keeping records of for six years.