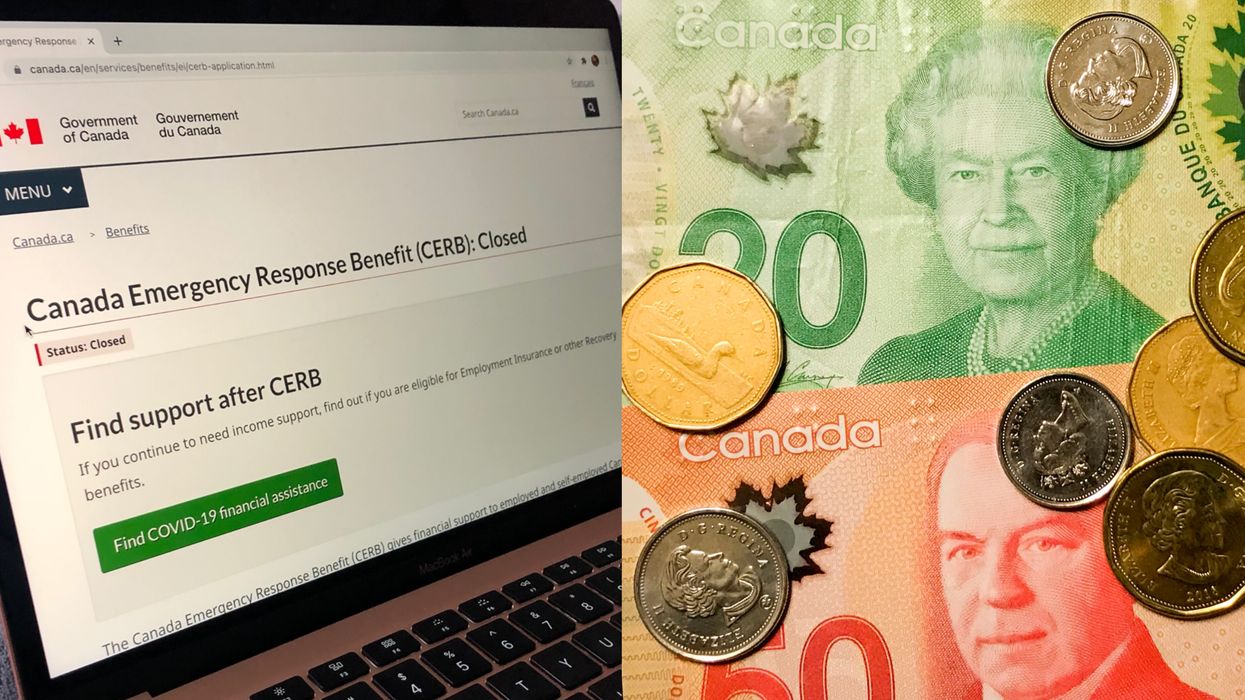

The CRA Says It Was Always ‘Clear’ That Canada's COVID-19 Benefits Are Taxable

If you’ve been wondering whether Canada’s COVID-19 benefits are taxable, the Canada Revenue Agency (CRA) has got answers.

In a new statement, the federal agency confirmed that all of the government’s COVID-19 benefits are taxable, including the Canada Emergency Response Benefit (CERB).

Editor's Choice: Jagmeet Singh Says Paid Sick Leave Is Essential For All Canadians Right Now (VIDEO)

Since the launch of these benefits, the Government of Canada has been clear that these benefits are taxable.

Canada Revenue Agency

The agency has already started sending T4A slips to CERB recipients, with the majority set to be received by March 10, 2021.

While Canada’s new benefits, like the Canada Recovery Benefit (CRB) and the Canada Recovery Sickness Benefit (CRSB) had tax withheld at source, these payments are still taxable, too.

In fact, experts have been urging Canadians to start preparing ahead of tax time, as they may end up owing more money than expected.

“Since the launch of these benefits, the Government of Canada has been clear that these benefits are taxable,” the CRA told CTV News.

“The benefit application pages also clearly stated that the benefits were taxable,” they added.

That said, federal government officials have already admitted that tax time in Canada is going to get pretty complicated this year.