Canadians Earning Less Than Usual Right Now Could Get $500 Per Week Via The CRB

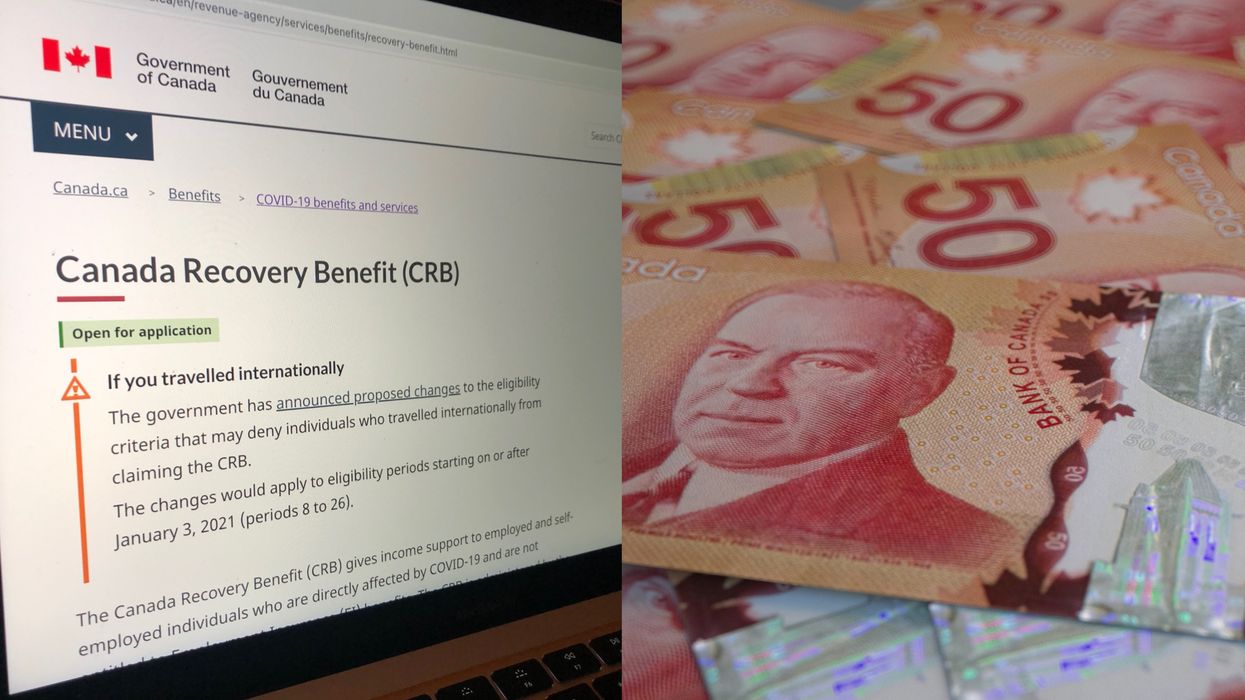

If you’re working fewer hours right now due to the COVID-19 pandemic, the Canada Recovery Benefit (CRB) may be able to help you out.

It’s one of the federal government’s new COVID-19 support benefits, designed to help those who’ve had their work-life affected by the ongoing pandemic.

Editor's Choice: Today Is Blue Monday & It's Apparently The Most Depressing Day Of The Year

What is the CRB?

After the Canada Emergency Response Benefit (CERB) ended last year, the federal government introduced three replacement benefits.

This includes the Canada Recovery Benefit (CRB), the Canada Recovery Sickness Benefit (CRSB) and the Canada Recovery Caregiving Benefit (CRCB).

The CRB aims to support people who are out of work or working reduced hours due to the COVID-19 pandemic.

It's administered by the Canada Revenue Agency (CRA) and offers $1,000 for a two-week period ($900 after taxes withheld.)

The money can be claimed for a total of 26 weeks (13 eligibility periods) between September 27, 2020 and September 25, 2021.

Who is eligible for the CRB?

To claim the CRB, an individual must be out of work due to reasons related to the COVID-19 pandemic.

Anybody with a 50% reduction in their average weekly income (compared with the previous year) due to COVID-19 may also apply for the benefit.

To qualify for the money, an individual must not be claiming any other COVID-19 benefits, short-term disability benefits or Employment Insurance (EI) benefits.

Applicants must also reside in Canada, be at least 15 years old, have a Social Insurance Number and have earned at least $5,000 in the 12 months before applying.

Per the eligibility requirements, those applying cannot be voluntarily out of work. This means you can’t have quit your job or reduced your hours voluntarily on or after September 27, 2020.

Does it have to be paid back?

If you are eligible for the CRB, you won't be required to pay back the money in full at a later date.

However, any Canadians who are later found to have claimed the CRB incorrectly, deliberately or accidentally, will be asked to return the payments.

The same applies if you receive money twice or in error.

It’s also worth remembering that all of Canada's COVID-19 benefits are taxable.

Although the CRB has taxes withheld at source, the amount received will still have to be declared on your tax return.

For this reason, some banks have been urging Canadians to prepare ahead for tax time, as some people may end up owing money to the government after claiming one of the benefits.