You Can Get $500 Per Week If You're Caring For A Child Or Family Member Right Now

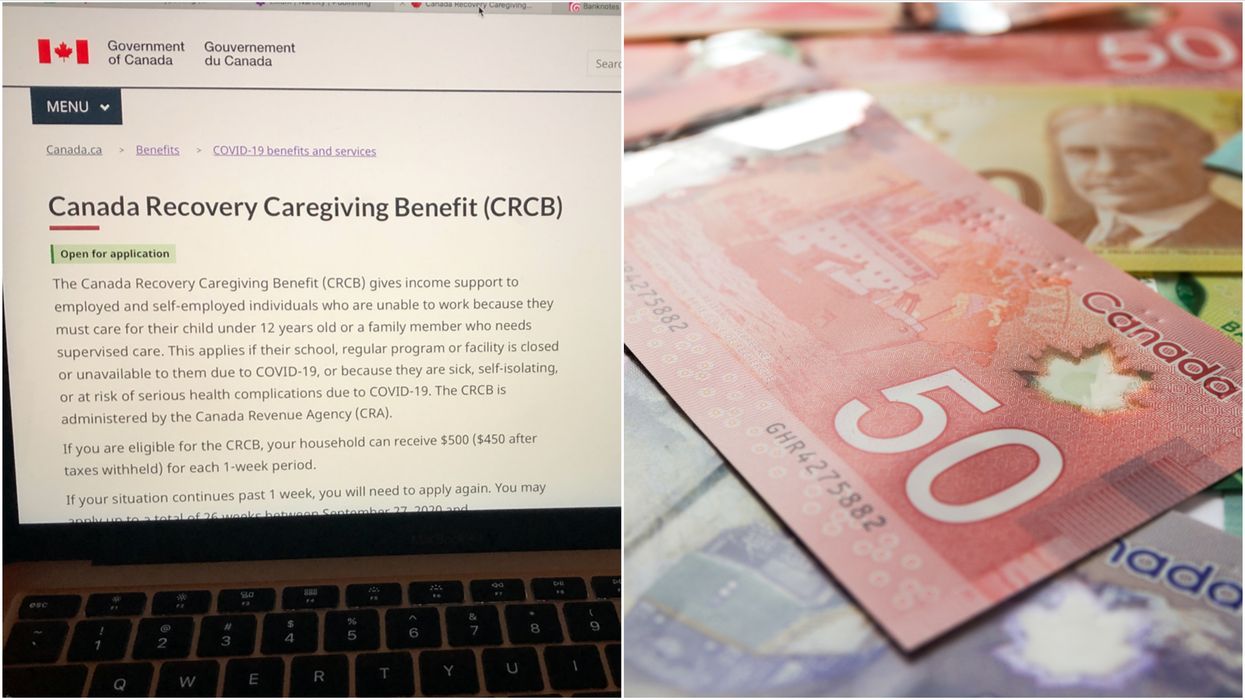

If you’re caring for a child or family member rather than working during the pandemic, you could be entitled to financial support via the Canada Recovery Caregiving Benefit (CRCB).

In October, shortly after the CERB was ended, the federal government launched three new “recovery benefits.”

This includes the Canada Recovery Benefit (CRB), the Canada Recovery Sickness Benefit (CRSB) and the Canada Recovery Caregiving Benefit (CRCB).

The aim of the trio of new programs is to provide more specific support to those who need it.

If you think you could qualify for the CRCB, here’s everything you need to know about claiming:

Editor's Choice: Elliot Page's Canadian Wife Shared A Sweet Message About Him Coming Out As Transgender

What is the CRCB?

The Canada Recovery Caregiving Benefit was created by the federal government to support individuals who are staying at home to care for others during the pandemic.

The benefit is administered by the Canada Revenue Agency (CRA) and it offers $500 (pre-tax) per household for every one-week period that it's applied for.

Tax is withheld at source, so eligible applicants will receive $450 into their accounts.

The CRCB can be claimed for up to a total of 26 weeks, between September 27, 2020 and September 25, 2021.

That said, claimants will have to re-apply on a weekly basis if their situation continues past one week.

Who can apply for it?

Per the government’s CRCB eligibility criteria, an individual must be either employed or self-employed on the day before their first application period.

In addition, an applicant must be unable to work at least 50% of their usual schedule due to their care responsibilities.

Eligible applicants will be caring for children under the age of 12, or a family member who needs supervised care.

Per the criteria, the people who need care must be at home for one of the following reasons:

Their school, daycare, day program, or care facility is closed or unavailable to them due to COVID-19.

Their regular care services are unavailable due to COVID-19.

The person under your care is: sick with COVID-19 or has symptoms of COVID-19, at risk of serious health complications if they get COVID-19, self-isolating due to COVID-19.

To qualify for the money, applicants must also reside in Canada, be at least 15 years old, have a Social Insurance Number and have not claimed any other related benefits.

Individuals must have earned at least $5,000 in 2019, 2020, or in the 12 months before applying.

Are there any other options?

During a Twitter thread earlier this week, Justin Trudeau broke down all of the COVID-19 response benefits Canadians can apply for right now.

This includes the CRB, which is there to support people who have lost income or their jobs due to the ongoing pandemic.

Alternatively, the CRSB was created to help those who get sick with COVID-19, or who have to isolate for reasons related to the illness.

As part of the fall economic statement on Monday, the government announced additional schemes to help Canadians through the pandemic.

This includes money for people working from home, as well as financial support for low and middle-income families.