Trudeau Just Laid Out Exactly Which COVID-19 Benefits You Could Apply For Right Now

Since the beginning of the pandemic, the federal government has launched a number of different COVID-19 benefits in Canada.

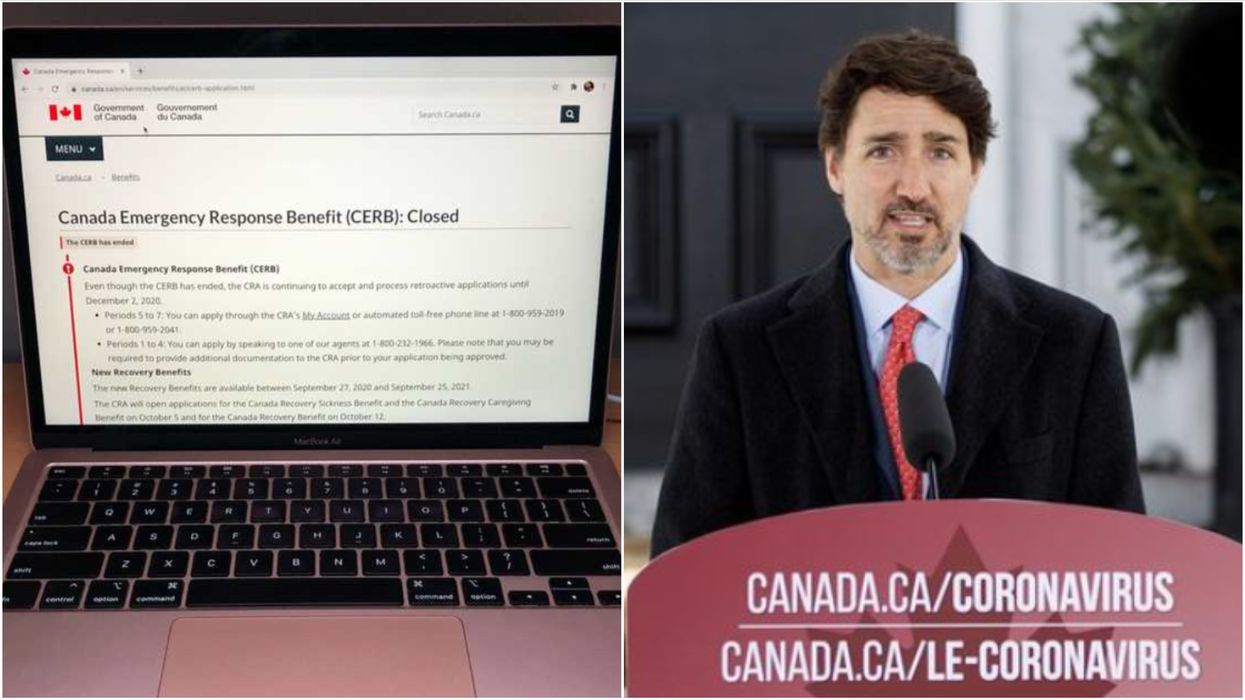

Some programs, like the Canada Emergency Response Benefit (CERB) have already been shut down, while others are relatively new and continue to change.

This means it can get a little confusing if you're unsure exactly what you are eligible for.

Fortunately, Prime Minister Justin Trudeau has taken to Twitter to provide a detailed explanation about each scheme and exactly who can apply for it.

"We’re doing everything we can to make sure you have what you need - during this second wave and beyond," he explained.

With that in mind, here's what's on offer for Canadians right now:

Editor's Choice: Canada's COVID-19 Cases Topped 360K & 2 Provinces Reported Record-Breaking Figures

The Canada Recovery Benefit

The Canada Recovery Benefit (CRB) provides financial support to those whose income has been affected by the pandemic, but who do not qualify for Employment Insurance (EI).

Eligible applicants can receive $1,000 ($900 after tax) for a two-week period, for up to 26 weeks.

To meet the eligibility requirements, an individual must have had a 50% reduction in their income due to COVID-19, or be unemployed as a result of the pandemic.

Applicants must not have applied for any other similar benefits and must have earned at least $5,000 in 2019, 2020 or in the year before applying.

Those applying should also reside in Canada, be at least 15 years old, and have a valid Social Insurance Number.

“If you're directly affected by COVID-19 but you’re self-employed or don’t qualify for Employment Insurance, the Canada Recovery Benefit is there for you,” promised Trudeau.

The Canada Recovery Sickness Benefit & Canada Recovery Caregiving Benefit

The Canada Recovery Sickness Benefit (CRSB) was launched at the same time the CRB replaced the CERB.

It’s different from the CRB, because it aims to support those who have lost income or are out of work due to health measures associated with COVID-19.

With the CRSB, you can get $500 per week ($450 post-tax) for two weeks if you're a worker who contracted COVID-19 or were exposed to the virus and have to isolate.

You could also be eligible for the CRSB if you have underlying conditions.

Meanwhile, the Canada Recovery Caregiving Benefit (CRCB) provides $500 per week ($450 post-tax) per household.

It's meant for people who aren't able to work for at least 50% of the week because a child needs care or a family member is sick or isolating.

The CRCB can be used for up to 26 weeks.

Canada Emergency Rent Subsidy & Canada Emergency Wage Subsidy

The Canada Emergency Rent Subsidy (CERS) and the Canada Emergency Wage Subsidy (CEWS) are there to support people who own a small business that’s been affected by COVID-19.

The CERS is there to cover up to 65% of commercial rent or property expenses for "qualifying businesses, charities and non-profits," starting on September 27, 2020 and lasting until June 2021.

Additionally, according to the PM, the new Lockdown Support could boost this subsidy up to 90% for those in locked-down regions.

The CEWS is there to support Canadian employers who have seen a drop in revenue during the pandemic.

Small businesses may be eligible for this subsidy which will help cover employee wages, retroactive to March.

Its purpose is to enable employers to re-hire workers and prevent job losses.

Trudeau also confirmed that a tool has been set-up on the federal government website, helping Canadians to work out exactly what they could qualify for.