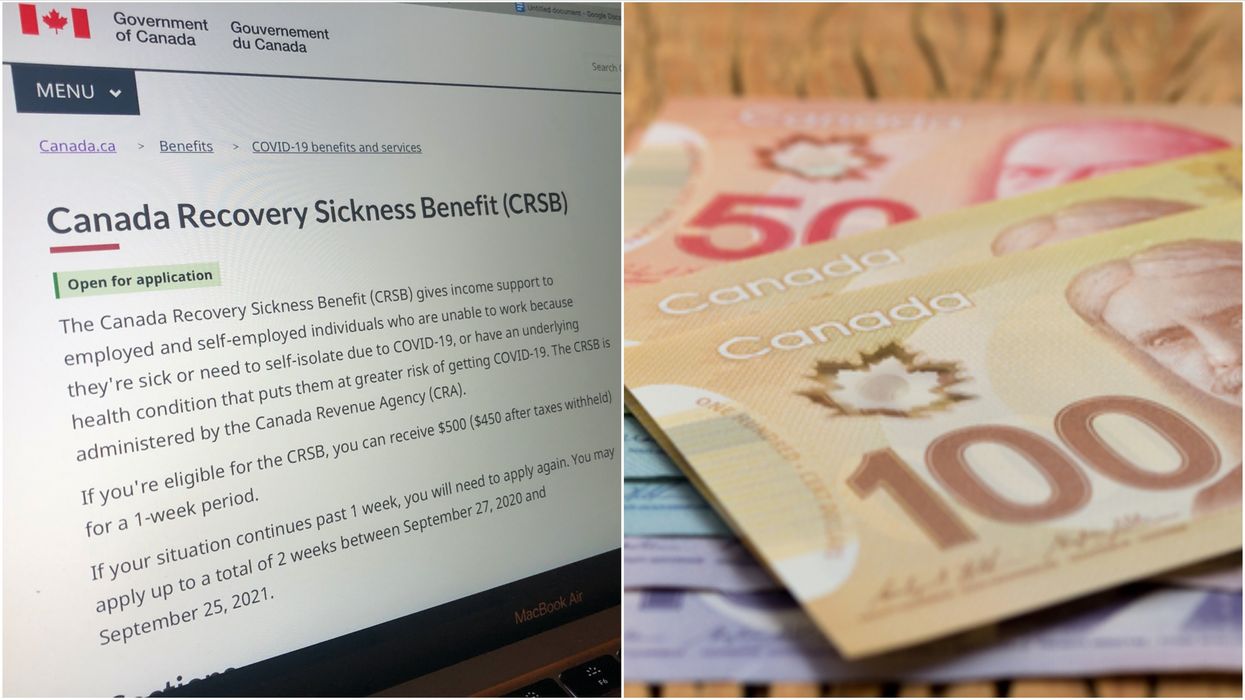

The CRSB Benefit Has Launched & You Can Get $500 Per Week If You Get COVID-19

To help Canadians during the COVID-19 pandemic, the federal government has launched the Canada Recovery Sickness Benefit (CRSB).

Its purpose, now that CERB has ended, is to provide income support to those who are unable to work if they become sick or need to isolate due to COVID-19.

The cash will also be available to qualifying Canadians who have underlying health conditions, which may put them at a greater risk of getting the illness.

The benefit is handled by the Canada Revenue Agency and eligible applicants can receive $500 per week, before taxes.

Its end date is September 25, 2021, and Canadians can apply for the cash for a maximum of two weeks.

Editor's Choice: Toronto Teens Rushed To Hospital After Horrible Crash Splits Porsche In Half

Who can claim the CRSB?

To apply for the $500 benefit, each person must meet all of the eligibility criteria as listed by the Government of Canada.

First and foremost, an applicant must be employed or self-employed on the day before their application.

The claimant must be unable to work at least half of their usual work week due to COVID-19 or associated symptoms, or because they have been advised to self-isolate.

Anybody unable to work as usual due to an underlying health condition is also eligible to apply.

You cannot claim the CRSB if you’re accepting others such as the Canada Recovery Benefit, the Canada Recovery Caregiving Benefit, short-term disability benefits, EI, workers' compensation benefits or the Québec Parental Insurance Plan.

You must also reside in Canada, be at least 15 years old, have a valid social insurance number and have earned at least $5,000 (before deductions) in the year prior to your application.

How do I apply for the CRSB?

If eligible, Canadians can apply by using the “My Account” section of the Canada Revenue Agency website.

From here, a direct deposit payment can be set up, which will take between three and five days.

Alternatively, it can be paid via cheque, which takes between 10-12 business days.

The initial application should be completed on the first Monday after the week you’re applying for has ended.

The benefit doesn’t renew automatically, so the process will have to be repeated if the applicant is sick or isolating for more than one week.

Do I have to repay the CRSB?

If you correctly apply for the benefit and are eligible to receive it, you won’t need to pay the money back.

It’s worth keeping in mind that the Canada Revenue Agency may validate your application before they send the cash — so it’s worth double-checking your eligibility before submitting.

Anybody who applies incorrectly or by mistake will be asked to return the money, ideally before December 31, 2020.

Canadians found to be deliberately making fraudulent claims could face further financial penalties or even jail time.