Canadians Who Need To Self-Isolate Can Now Get $500 Per Week With The CRSB

If you get sick or have to isolate due to COVID-19 concerns, the CRSB has got your back.

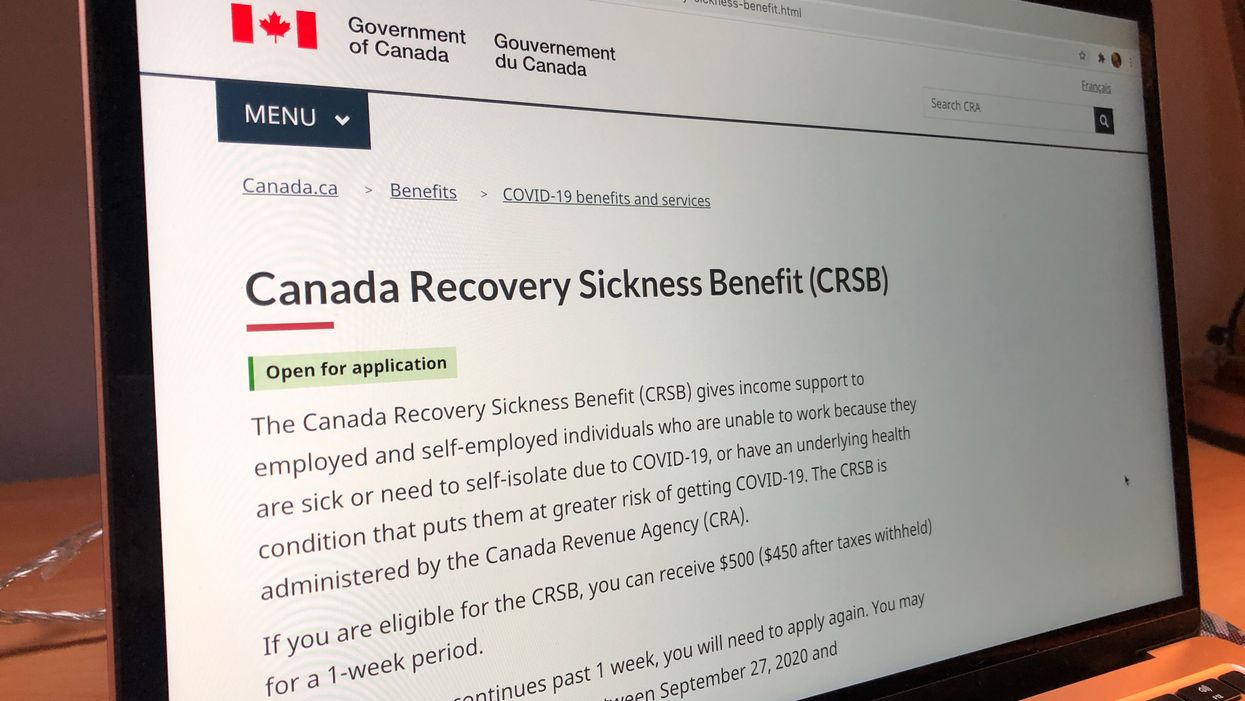

The Canada recovery sickness benefit (CRSB) has been specifically created to support Canadians who are losing income due to the effects of the global pandemic.

This includes eligible people who test positive for the illness, display symptoms of COVID-19, or who have underlying health conditions that may make them vulnerable.

The benefit is handled by the Canada Revenue Agency (CRA) and qualifying applicants can receive the financial support for up to two weeks.

Editor's Choice: Matty Mattheson Has A New Burger Joint In Toronto & It's Already So Popular

How much does the CRSB pay out?

Those who meet the eligibility requirements for the Canada recovery sickness benefit can claim $500 for each one-week period.

To make things a little easier, the CRA withholds the tax at source, which means applicants can get $450 per week post-tax.

The benefit can be claimed for up to two weeks in total, between the dates of September 27, 2020 and September 25, 2021.

The two weeks are not required to be taken consecutively.

While the claimant must have lost more than 50% of their weekly income to apply, the CRSB payment amount will not change based on the work they did complete.

Who can claim the CRSB?

The CRSB is open to a number of people, specifically those who are sick with COVID-19, have symptoms of the illness or who have been told to self-isolate.

Per the Government of Canada’s eligibility criteria, qualifying individuals must be employed or self-employed prior to their first application period.

To get the cash, applicants must be unable to work at least 50% of their usual schedule due to sickness or self-isolation.

Individuals can be self-isolating due to a positive COVID-19 test, related symptoms or an underlying health condition that makes them vulnerable.

Eligible claimants can also get the benefit if they’ve been asked or advised to self-isolate.

Candidates must also be a Canadian resident, at least 15-years-old, have a SIN number and not be receiving any other COVID-19 benefits.

Who can tell you to self-isolate?

Whether or not an individual can claim the $500-per-week benefit could depend on exactly who has given the advice to self-isolate.

Per the government’s criteria, the suggestion to stay-at-home must have been issued by a specific authority in order for a person to be eligible for the CRSB.

The list of who can officially ask somebody to isolate includes their employer, a person in authority, the government and local public health authorities.

Medical practitioners and nurse practitioners are also qualified to give this advice, according to the federal government’s list.

Some of these authorities are also able to issue stay-at-home advice to those with underlying health conditions, which could help them qualify for CRSB payments, too.