CRB & CRSB Payments Are Still Taxable Despite The 10% Deduction Up Front

It’s worth double-checking what you may owe come next year. CRB and CRSB payments are still taxable, despite the 10% deduction taken by the government up front.

Canada’s latest benefits are there to financially support Canadians who may be out of work or who may become ill during the COVID-19 pandemic.

While the Canada Revenue Agency (CRA) already deducts 10% of the CRB or CRSB payments that come into your account, this doesn’t necessarily mean you won’t have to pay any additional tax on the benefits.

Editor's Choice: Canada Just Reported Its Highest Ever Single-Day Jump In New COVID-19 Cases

“

The 10% tax withheld at source may not be all the tax you need to pay.

Canada Revenue Agency

Like the CERB, the federal government says you may need to pay back more (or less) come tax time, depending on how much income you earned.

As part of the application process for both benefits, the government explains, “You must still report CRSB payments you receive as income when you file your personal income tax return.”

To help you do this, the CRA will send you a T4A tax information form for the amount you received in COVID-19 benefits.

When it comes to the CRB, there's a possible cap on how much you can keep, too.

If you earn more than $38,000 in the calendar year, you’ll have to repay $0.50 of the CRB for every dollar of net income you earned above that.

"This will be due at the same time as your income tax return for the year," explains the government.

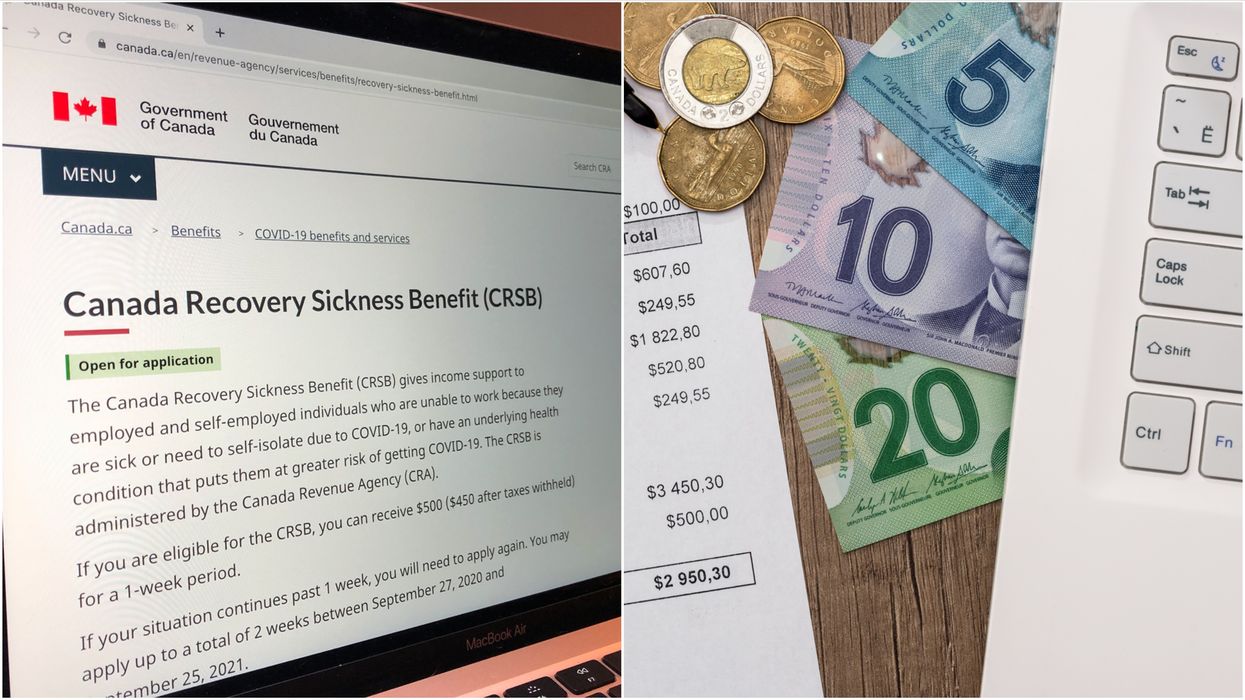

*This article's cover image is for illustrative purposes only.