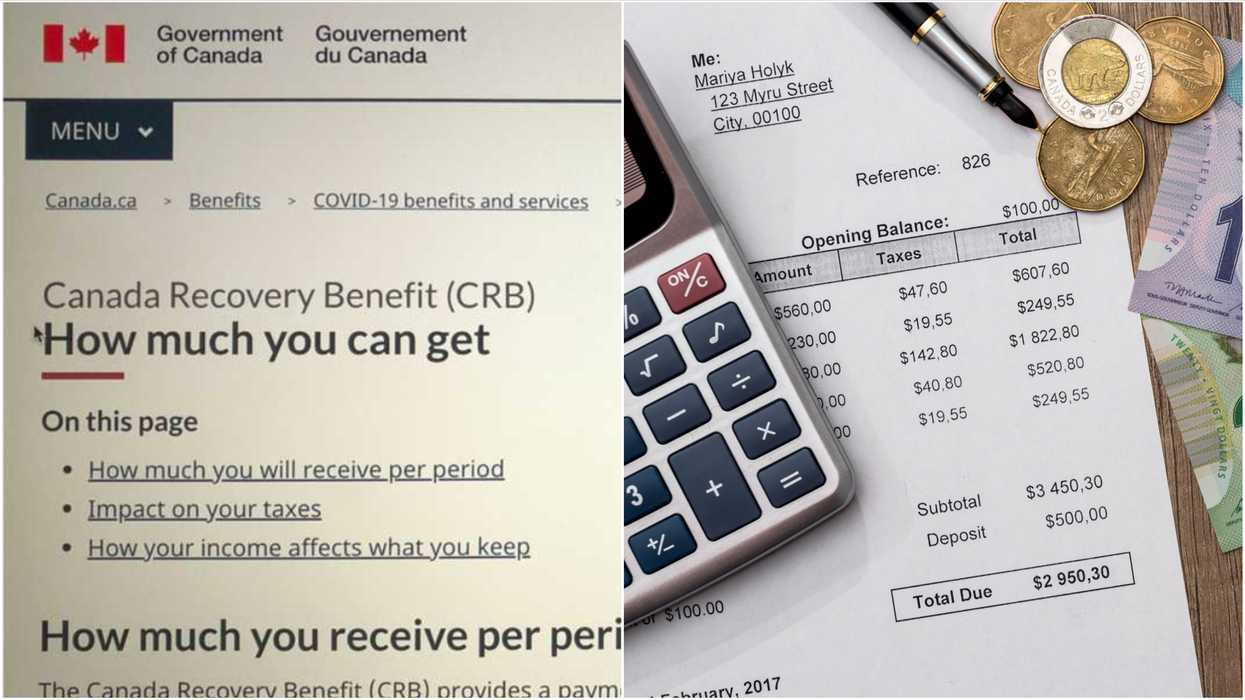

The CRA Just Explained How It Decides If You Need To Pay Back COVID-19 Benefits

If you’ve been claiming federal COVID-19 benefits such as the CRB, repayments could be just around the corner!

In an email conversation with Narcity, the Canada Revenue Agency confirmed that they will be looking into claimants ahead of tax time.

Anybody who is found to have claimed COVID-19 benefits they were not entitled to, accidentally or not, will be asked to pay it back.

Editor's Choice: Canada Was Just Named The 2nd Best Country In The World

We will take steps to verify that claimants were eligible to receive these payments.

Canada Revenue Agency

The CRA explained to Narcity that they have a record of who receives which benefit, and for what period.

This is checked against tax slips received from employers, as well as “other relevant information available to the CRA,” to validate eligibility.

This will be completed by the next tax filing season.

“In cases where claimants are found to be ineligible, they will be contacted to make arrangements to repay any applicable amounts,” confirmed the agency.

It's also worth remembering that COVID-19 benefits like the CERB, CRB and CRSB are taxable, even if some of the money is already withheld at source.