Self-Employed Canadians Who Repaid The CERB Can Get Their Money Back Starting Today

Here's everything you need to know. 💰

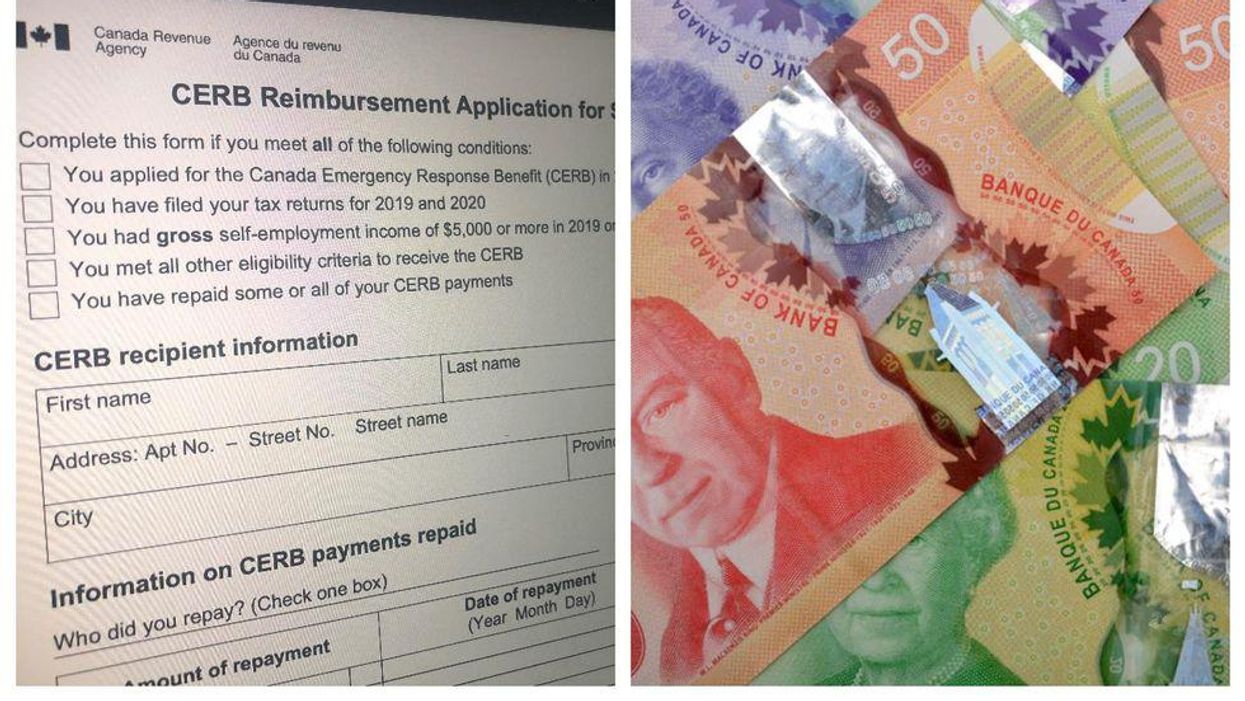

The Government of Canada has confirmed that it will begin reimbursing eligible self-employed Canadians who repaid the CERB, starting from May 27, 2021.

In a notice, the Canada Revenue Agency (CRA) shared additional details related to eligibility for the refund, in addition to the process for claiming it.

If you think you might qualify for here's what you need to know.

Why are the feds returning CERB payments?

Back in February, the federal government revealed that Canada Emergency Response Benefit (CERB) repayments would be scrapped for some Canadians after confusion related to the benefit's eligibility criteria.

This impacted self-employed Canadians in particular, as eligibility factors related to gross and net income led some to claim the money incorrectly.

On May 27, the feds explained what will happen to those who already paid back the benefit. This includes self-employed individuals who may have returned their CERB payments before it was announced that they wouldn't have to.

Who is eligible to get their money back?

All self-employed Canadians whose net income was less than $5,000 and who applied for the CERB will no longer be required to repay the benefit.

That said, they must have filed their 2019 and 2020 income tax returns by December 31, 2022, and have met all other CERB eligibility requirements at the time they applied for it.

Additionally, their gross self-employment income must have been $5,000 or more in 2019 or in the 12 months prior to their original CERB application.

Those who meet the above criteria but have already repaid the money will be fully reimbursed by the CRA.

How do I get a CERB reimbursement?

From May 27, 2021, eligible Canadians who voluntarily repaid all or part of the CERB to the CRA or Service Canada can request a refund.

All reimbursements will be processed by the CRA via the agency's Application for Self-Employed Individuals, which can be submitted electronically or by mail.

The agency is set to begin processing refund applications after June 15, 2021. Those who are eligible for money back can "expect reimbursements within approximately 90 days of submitting their applications to the CRA."

Those who have not made a CERB repayment, but still meet the eligibility criteria for the remission order, do not need to take any action.

- CERB Repayments: The CRA Just Explained What You Need To Do ... ›

- Repay The CERB: Canada Has An Online Quiz To Help You Find ... ›

- CERB Repayments Are Getting Scrapped For Some Canadians ... ›