Jagmeet Singh Says The Bank Of Canada's Interest Rate Increases Have 'Absolutely No Merit'

The NDP leader claimed that the "rapid and sharp increase in interest rates" will likely cause a recession.

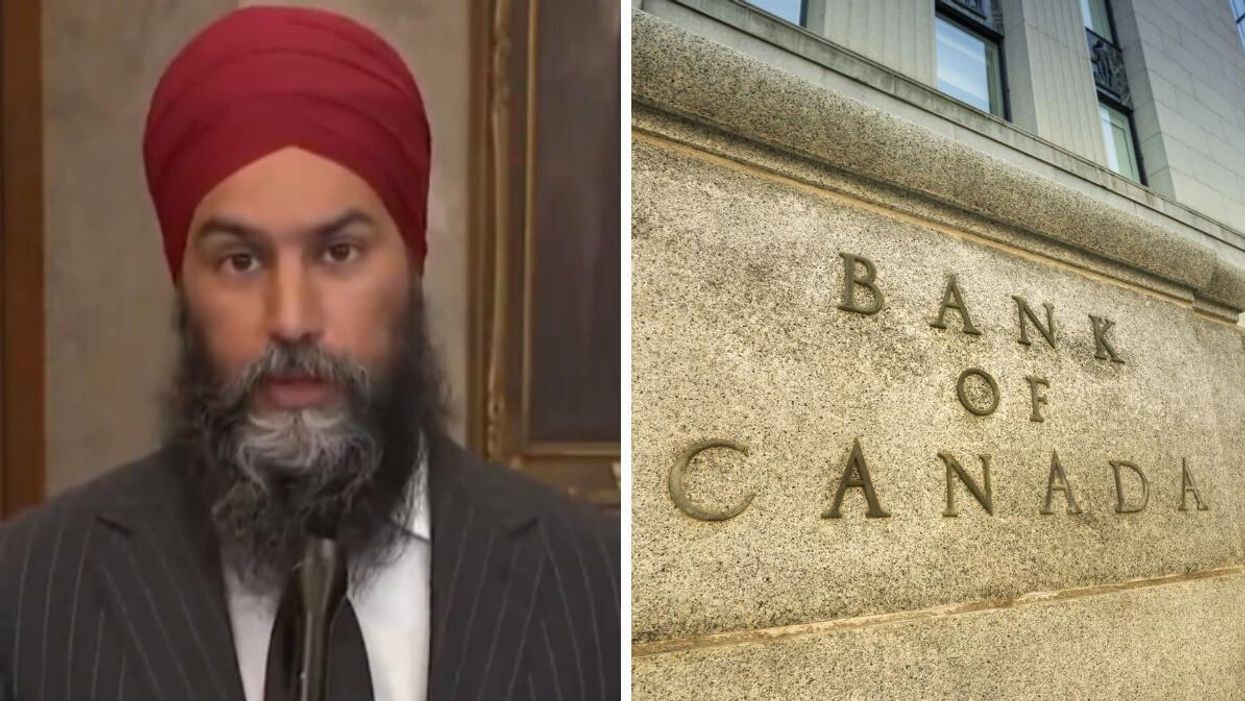

Jagmeet Singh speaking at Parliament Hill. Right: Bank of Canada sign.

Jagmeet Singh has said that the Bank of Canada's approach to interest rate increases has "absolutely no merit."

During CTV's Question Period on Sunday, October 23, the NDP leader was asked about what more the federal government can do to help Canadians, if the feds should spend more to deal with inflation and what his thoughts on a possible recession are.

"We absolutely need to combat inflation, but if the Bank of Canada's approach has nothing to do with the root causes of inflation, and it's only going to cause pain for Canadians, then we've got to question why is that the approach they're taking when there's no evidence for that approach," he said.

Singh said that the causes of inflation, which drive up costs, are the war in Ukraine, issues with the supply chain and "corporate greed."

"So, how is increasing interest rates going to address any of those concerns? What it will do is create a self-inflicted recession in Canada, which is going to mean more and more people are going to feel pain, and there are going to be job losses," the NDP leader said.

"We can invest in solutions to fix what's going on, but we can do that in a very prudent way," he continued.

Singh suggested that the federal government "stop the waste" and then redirect that money into programs like Employment Insurance to help Canadians if they lose their jobs.

When asked if he thinks a recession is inevitable, Singh said that the "rapid and sharp increase in interest rates" will likely cause a recession that could've been avoided.

The NDP leader also said that the Bank of Canada is using an approach that has been used in the past but during times when wages were high.

"I don't think that that's the right approach, even in the case of high wages. I think there's other options," he continued. "In this case, there's absolutely no merit to their approach."

Why is the Bank of Canada increasing interest rates?

In a Twitter thread posted in July, the Bank of Canada broke down why it's increasing interest rates.

To start cooling off what it called an "overheating" economy, the Bank of Canada has been bumping up the prime interest rate in 2022.

The goal is that people and businesses will stop or slow their spending and borrow less, which will also cause them to buy less.

"Less demand brings the economy back into balance, putting the brakes on inflation," the bank said.

Is there a recession coming in Canada?

As experts predict a "modest" recession in 2023, Narcity spoke with Lisa Hannam, the executive editor of MoneySense.com, to figure out how you can "recession-proof" your life.

Hannam said that the question now isn't if and when a recession will happen but rather how Canadians can prepare for what could happen in the next 12 to 18 months.

That includes setting up an emergency fund, checking up on your investments, assessing your budget, reconsidering upcoming big expenses and more.

This article's cover image was used for illustrative purposes only.