A Canadian Guide To Scoring Major Discounts On Car Insurance Right Now Was Just Revealed

Canadians are probably looking for ways to save money right now. Car insurance in Canada, like anywhere else, can cost people quite a bit. Luckily, there is some new advice on how people can save on this essential part of owning a vehicle.

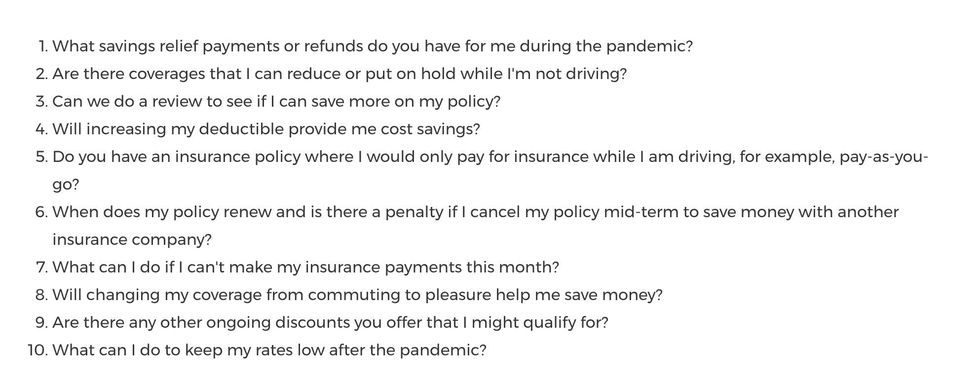

In a June 12 news release, the Canadian automobile association CAA revealed that there are ten key questions you can ask in order to get more savings.

The non-profit organization found in a recent survey that nearly one out of five members didn't know that most insurance providers will actually offer discounts and relief during COVID-19.

One of the questions directly related to finding those pandemic savings is just directly inquiring about any financial relief the company may be offering.

Canadians are also encouraged to ask if they can reduce or put their coverage on hold while they are not driving. This could potentially be good for people who have lost their jobs or are working from home.

Other inquiries car owners can make are just asking for discussions about where they can save money on their policy and the effect of raising their deductible.

Finally, drivers can ask what actions they can take to keep their rates low, even after the pandemic.

"As of right now, much of the relief provided by insurance companies during the COVID-19 pandemic will soon expire, and customers will be looking for ways to continue to save since many cars are still sitting in the driveway," Elliott Silverstein, director of government relations at CAA Insurance said in a statement.

Considering the rise in dangerous driving and illegal street racing that came after a reduction in cars on the road, finding ways to save on insurance probably isn't a bad idea.

People might even end up driving less in the future anyway, as some companies indicate that they will permanently move to a work-from-home model.