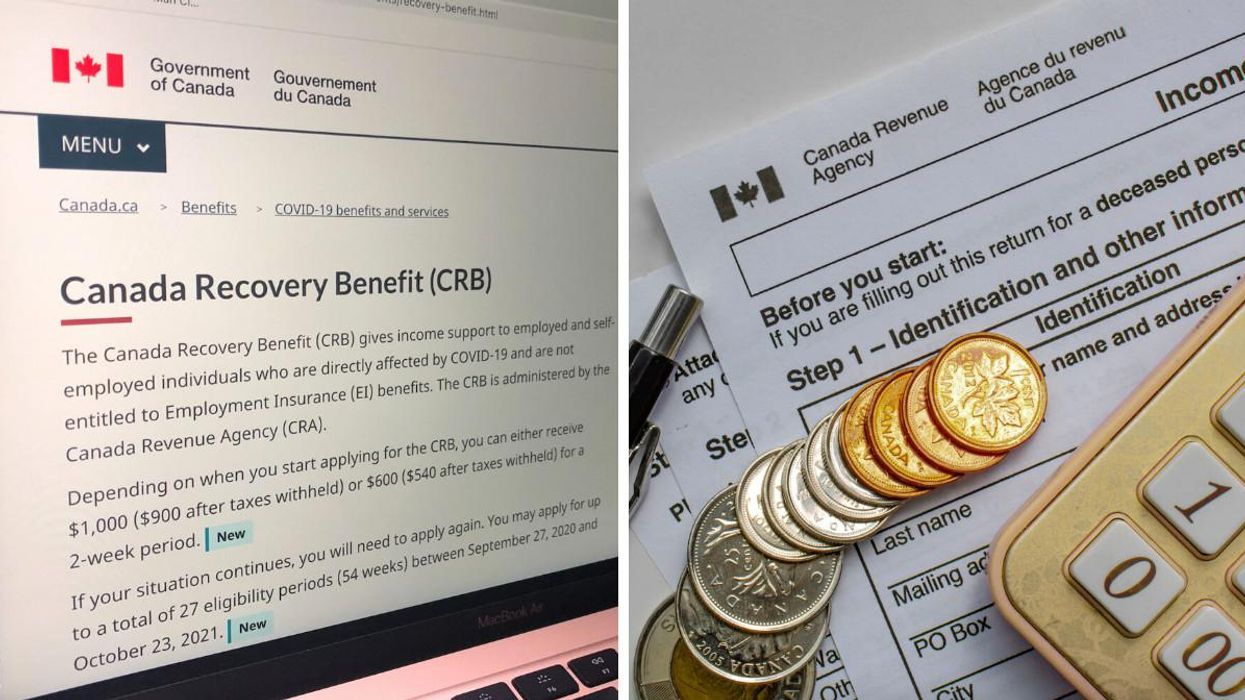

Canadians Who No Longer Qualify For EI Can Start Claiming The CRB & Here's How It Works

Eligible applicants can claim $600 per two-week period.👇💰

The federal government is reminding Canadians who are no longer eligible for Employment Insurance (EI) benefits that they may qualify for the Canada Recovery Benefit (CRB).

As of September 12, 2021, EI claimants who have used up all of their weeks of regular benefits may be able to receive the CRB, provided they meet the eligibility criteria.

This means EI claimants will be able to access the same maximum number of weeks of benefits as those receiving the CRB.

Those who are eligible will receive $600 for each two-week period, minus taxes withheld, between September 26, 2021, and October 23, 2021.

Once an individual's EI benefit period has ended, they must wait for the current CRB period to end before applying. If the EI benefit period ends during a CRB two-week period, it is possible to apply for the second week.

It's worth keeping in mind that the CRB does not renew automatically. Instead, claimants must continue to re-apply after each two-week period.

How do I apply for the CRB?

The fastest way to apply for the CRB is to submit an application via the Canada Revenue Agency's My Account portal. Applicants must file their 2019 or 2020 taxes before submitting the request.

It's important for each individual to check whether their EI benefit period is still open, as this may cause issues when completing the CRB application.

The CRB is currently set to end after period 28, from October 10 to 23, 2021.

This article's cover image was used for illustrative purposes only.