The CRB Has Ended In Canada But It May Still Impact Your Taxes Next Year

Some Canadians will be required to "reimburse some or all of the benefit at tax time."👇💰

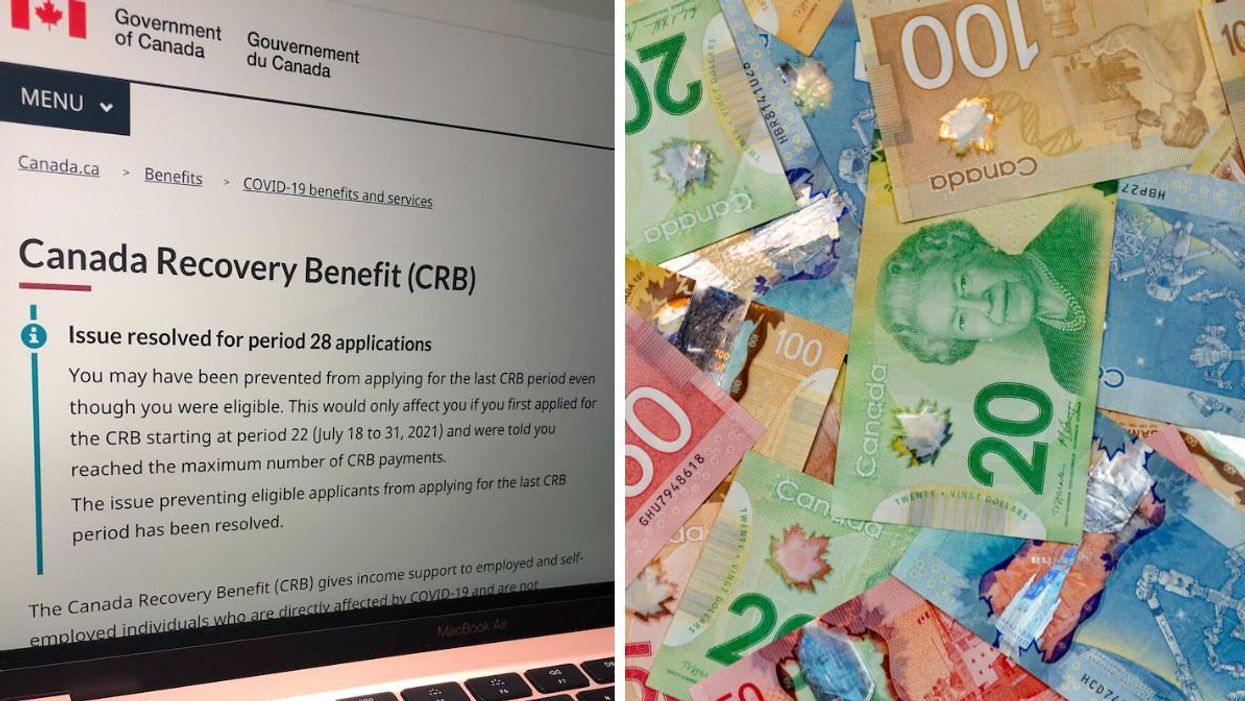

The Canada Recovery Benefit (CRB) has officially ended, but that doesn't mean those who claimed it can stop thinking about the benefit altogether.

That's because there may still be tax implications next year, particularly for those who earned over $38,000 net income in the calendar year.

Since they were launched in 2020, all of Canada's COVID-19 recovery benefits withheld 10% tax at source. This means Canadians had effectively already paid the tax on the payments before even receiving them.

Who will have to pay the CRB back?

This applies to the CRB when it was offering $1,000 biweekly ($900 after taxes withheld) and also when it was lowered to $600 biweekly ($540 after taxes withheld).

However, the federal government is warning CRB claimants that the 10% tax may not be all the tax they need to pay. "You may need to pay more (or less) depending on your personal tax situation," it says.

Those who earned over $38,000 net income in the calendar year will be required to return some or all of the benefit at tax time in 2021, just like in 2020.

Individuals who earned above this amount must reimburse $0.50 of the CRB for every $1 of net income earned above $38,000 on their income tax return. No one will be required to repay more than their total benefit amount for the year.

On the federal government's website, there is a tool to help Canadians work out whether they may be required to pay back some of the CRB during the tax season.

- The Canada Worker Lockdown Benefit Is Here & This Is Everything ... ›

- Jagmeet Singh Is Calling On Trudeau To Extend The CRB 'For As ... ›

- The CRB Is Ending In October & Here's The Official Advice For ... ›

- Two Of Canada’s COVID-19 Recovery Benefits Will Officially Be Extended Until May 2022 - Narcity ›

- Two Of Canada’s COVID-19 Recovery Benefits Will Officially Be Extended Until May 2022 - Narcity ›

- Feds Say Canada’s COVID-19 Benefits Are Likely To Cost $7.4 Billion Over The Next 7 Months - Narcity ›

- Some People Who Got CERB Will Reportedly Get Notices That They Still Need To Repay The Money ›

- COVID-19 Benefits Will Impact Your Taxes & Here's What You Need To Know This Year - Narcity ›