Here's Exactly How Your Taxes Will Be Impacted If You Claimed COVID-19 Benefits

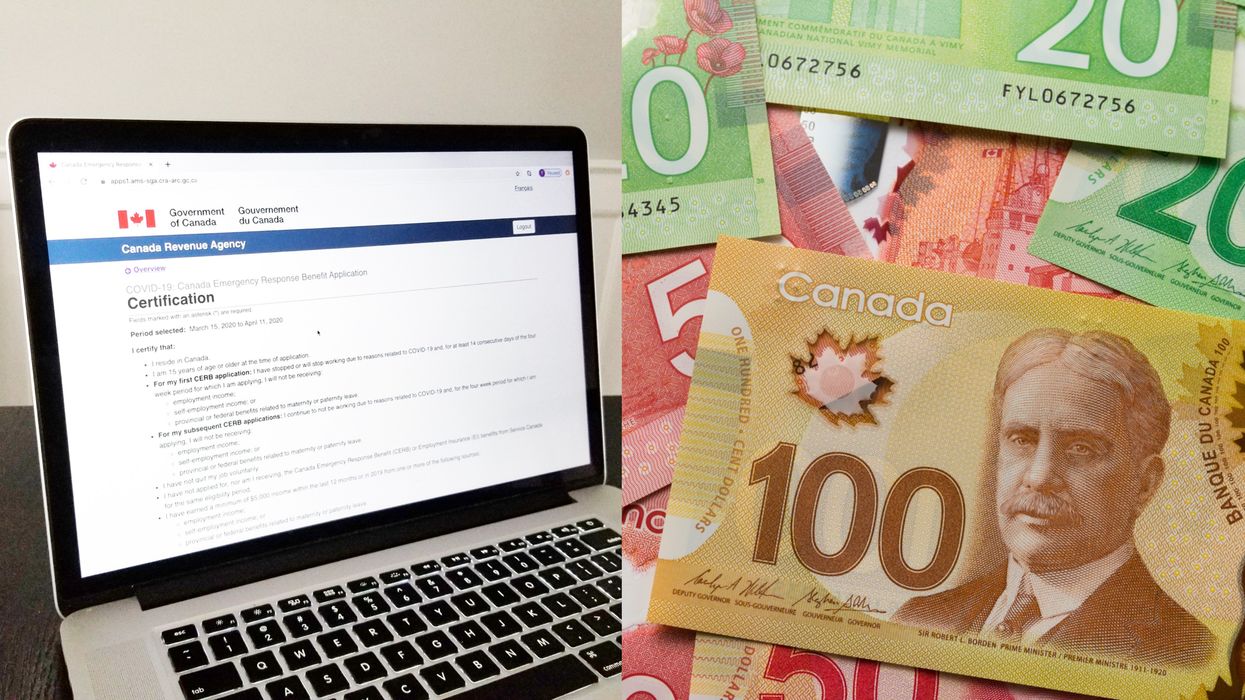

After millions of Canadians claimed Canada's COVID-19 benefits last year, many are now wondering how the funding will impact their taxes.

Ahead of what’s set to be an “incredibly complicated” tax season, one expert chatted with Narcity about what Canadians should expect this year.

Gerry Vittoratos, national tax specialist at UFile, explained that many people who received COVID-19 benefits may owe money at tax time, especially those who claimed the Canada Emergency Response Benefit (CERB).

Editor's Choice: Here's What Happens If You Mess Up Your Taxes In Canada According To An Expert

What impact will the CERB have?

If you claimed CERB for a long period of time in 2020, Vittoratos warns that you’re likely to have a balance owing on your income tax return.

He explained that this is because the federal government did not deduct any tax at source from the CERB.

This means that when a claimant files their tax return, they’ve automatically “underpaid” the government for the $2,000 per month benefit.

“Remember that a tax return, at its base, is a reconciliation statement,” Vittoratos told Narcity. “You are determining if you’ve paid too much (refund) or too little (balance owing).”

“For most Canadians, a refund is the result because they have already paid their taxes through their payroll,” he added.

When it comes to the CERB, since no tax was paid at source, he says the result will “almost certainly be a balance owing.”

What about other COVID-19 benefits?

For Canadians who claimed one of the government’s new recovery benefits, things are a little easier.

This includes the Canada Recovery Benefit (CRB), Canada Recovery Sickness Benefit (CRSB) and the Canada Recovery Caregiving Benefit (CRCB).

For these benefits, 10% of tax was automatically deducted from every payment upfront.

This means Canadians had effectively already paid the tax on the benefit before even receiving it.

However, this doesn’t mean recipients won’t owe anything come April, says Vittoratos.

“For the CRB, there were some deductions at source, however it was a minimal amount (10% of the benefit received),” he explained.

This means some people may still end up owing money to the CRA when tax time comes around, depending on their income.

What about the interest relief?

Fortunately for those who may owe money come tax time, there is additional support out there.

Earlier this month, the Canadian government announced that an interest holiday would be available to Canadians who have a balance owing for 2020.

In particular, this interest-break is for those who claimed the CERB or other COVID-19 benefits and have a taxable income of $75,000 or less.

The tax-guru explained, “These individuals can pay their balance owing with no interest charges by April 30, 2022.”

If you do end up getting confused come tax time, don’t worry too much.

Vittoratos told Narcity that while it’s super important to file your taxes properly, you probably won’t go to jail for making mistakes!