Here's Exactly How To Repay The CERB If You Want To Do It Before 2021

The new year is just around the corner, which means Canada Emergency Response Benefit (CERB) repayments are on the horizon for thousands of Canadians.

While the Canada Revenue Agency (CRA) has faced calls from leading politicians and the public alike to scrap the repayment scheme, the agency has made it clear that there are no plans to let people off.

If you think you may need to return some money, perhaps before December 31, here’s what you need to know:

Editor's Choice: Canada's Top Baby Names In 2020 Are So Different From 20 Years Ago

Why do some people need to repay the CERB?

Earlier in December, the CRA revealed that 441,000 Canadians had been contacted about CERB repayments.

Individuals may have been asked to return some or all of the benefit for different reasons, for example, if they accidentally claimed too much money or received double payments.

Some Canadians may have been contacted by the agency if they initially believed that they were eligible for the benefit, but later found out that they didn’t qualify.

A considerable number of self-employed people have also been contacted about returning the CERB, following confusion about the benefit’s eligibility criteria when it comes to net or gross income.

When is the CERB repayment deadline?

While there is no set deadline for Canadians to repay the CERB, the CRA is encouraging people to do it before December 31, 2020.

As the CERB is taxable, those who don’t pay before 2021 may have their 2020 income tax return impacted, according to the agency.

This means the amount claimed in CERB will appear on the applicant’s tax slips in April and therefore will need to be reported as income.

Leading politicians, such as NDP leader Jagmeet Singh and Green Party leader Annamie Paul, have repeatedly called on the CRA to scrap or suspend these repayments.

Singh says the government "made a mistake" when it came to the benefit’s eligibility criteria, while Paul suggests that asking people to repay potentially thousands of dollars during a pandemic is “heartless.”

How do I return the CERB?

First, anybody returning money needs to confirm whether their benefit came from the CRA or Service Canada.

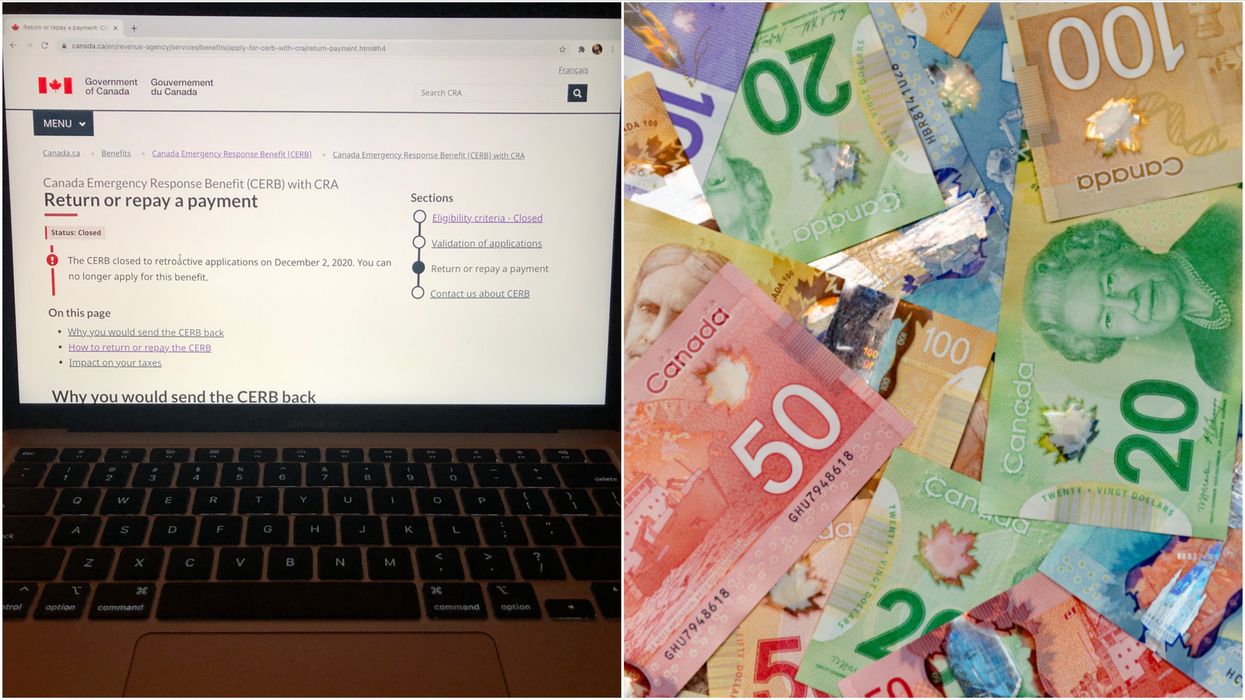

The benefit must be returned to the same place it came from. Anybody who’s unsure which agency sent their benefit can double-check by using the federal government’s CERB repayment website.

Using the same website, claimants can decide the best way for them to pay back the funds.

Returns can be completed via mail or by sending back direct deposits online via the government's “My Account” system.

The CERB can even be sent back by using online banking, simply by adding the Canada Revenue Agency as a payee.